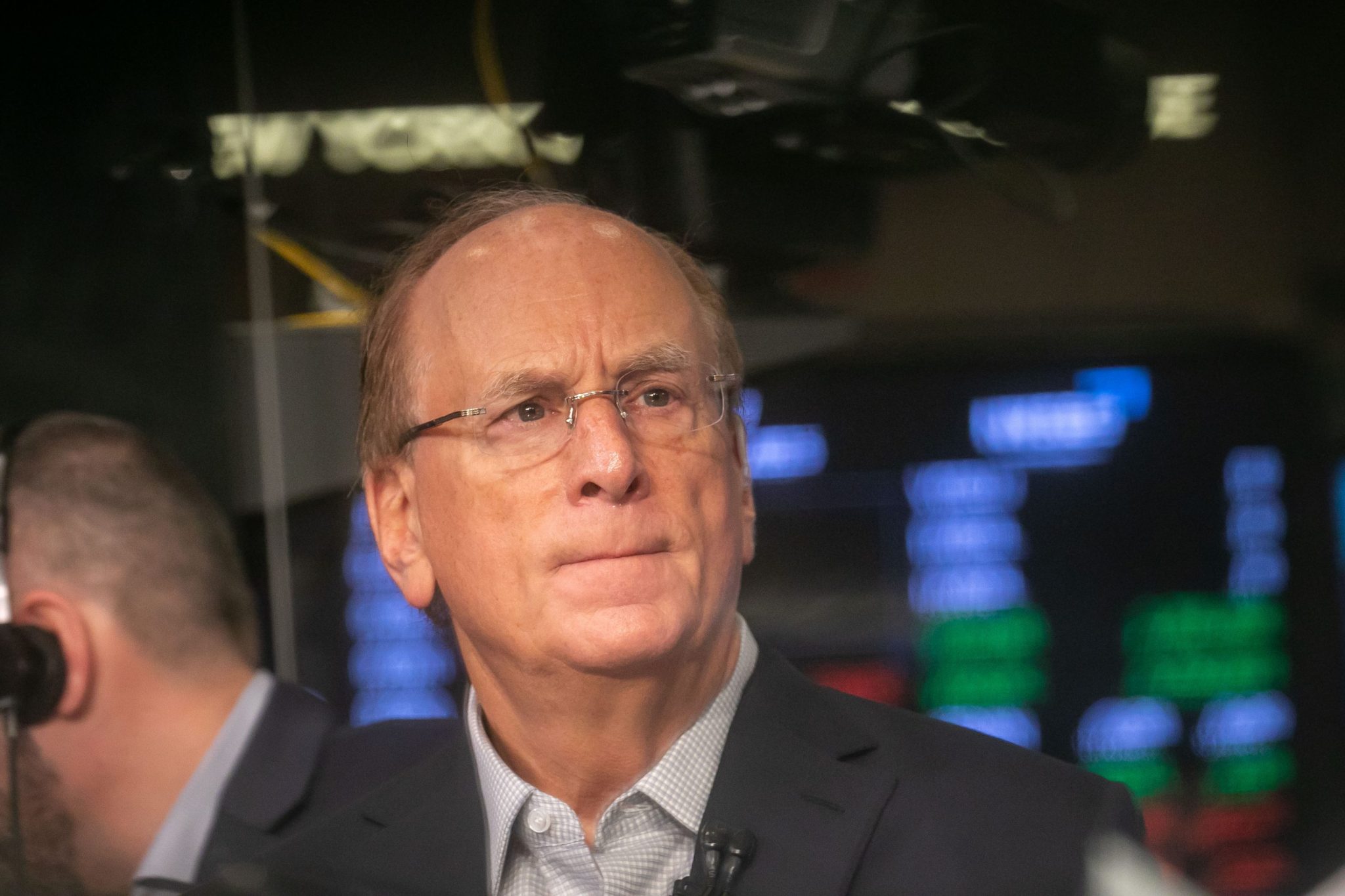

BlackRock Boosts UK Investments as Larry Fink Sees "Capitulation Point" Reached

Larry Fink, the CEO of the colossal investment firm BlackRock with $11.6 trillion under management, often takes unconventional positions. This time, he might be placing his bet on the beleaguered UK economy as his next big move.

Fink states that BlackRock is broadly investing in U.K. assets following assurances from the Labour government’s "growth-oriented" strategy. He further notes that both the U.K. and Europe are poised for an upturn as they have identified their "point of capitulation."

The chief executive of BlackRock, who is 72 years old, sees potential for investment in the UK market. He specifically mentions financial sector stocks such as NatWest, Lloyds, and St. James’s Place, suggesting these equities may have been underestimated due to negative sentiment which he believes was "probably unwarranted."

During his interview with the Times Fink cited multiple instances of evolving public behaviors as evidence for his belief in the U.K.'s capacity to uncover new growth prospects. He also contended that Keir Starmer’s administration was concentrating on tackling "tough challenges."

It really struck a chord with me—how there are numerous inherently robust qualities within the U.K. and Europe, which have been overshadowed by excessive regulation and overly stringent controls," he stated. "To me, it was evident that we had reached a critical juncture.

Fink's optimistic reflections on the UK economy stand out against prevailing views, which depict the country as lagging behind in growth and teetering on the brink of a recession along with potential departure of its wealthiest individuals.

Companies have voiced concerns over new requirements for national insurance and flexible work regulations, which they believe complicate hiring and expansion efforts. Additionally, there are accounts of wealthy individuals jumpstarting their activities. a mass exodus due to alterations in non-domiciled tax laws. billionaires and real estate investors, Ian and Richard Livingstone, were among the latest To leave the U.K., joining thousands of others since last May’s election.

The UK is additionally feeling the strain on its already constrained government budgets due to the threatening moves from the Donald Trump administration regarding extensive retaliatory tariffs. These could substantially impact economic growth.

These pressures appear to be driving the dominant sentiment among the U.K. public.

A poll conducted by Ipsos MORI indicated that 75% of British people anticipate the economy will deteriorate within the coming year, representing the most pessimistic outlook from the public since this survey began in 1978. This finding comes from their study. Economic Optimism Index registered a score of -68, which was lower than the outcomes observed during the cost-of-living crisis in 2022, the Global Financial Crisis in 2008, and the onset of a worldwide economic downturn starting in 1980.

This sentiment mirrors what many companies are experiencing as they start fortifying themselves against a potential downturn sparked by the tariff conflict. In March, the U.K.'s Purchasing Managers' Index dropped to its lowest point since 2022, indicating that firms are cutting back on operations due to diminished confidence.

Even with this contradictory evidence, Fink remains more optimistic about the U.K. compared to his attitude during the last part of Rishi Sunak’s time as prime minister. Bloomberg reported Last year, BlackRock was one of the investment groups courted by Chancellor Rachel Reeves with the aim of helping reconstruct Britain.

I feel more assured about the economic condition of the U.K. now compared to what I felt a year earlier.

Fink bemoans the shortage of room.

An impediment that could potentially stall BlackRock's advancement into the U.K. market is the availability of office space.

Fink is eager to gather all of his roughly 3,000 London-based staff members into a single location to speed up the company’s investment in the U.K. However, he's encountering obstacles due to the scarcity of available properties.

“I am so short of space here in London with all our acquisitions. I need an office tomorrow, but there is nothing here,” Fink told the Times .

If I were certain that I could start construction within the coming year, I would build our own.

The tale was initially showcased on Cryptonesia

0 Response to "BlackRock Boosts UK Investments as Larry Fink Sees "Capitulation Point" Reached"

Post a Comment