Ethereum (ETH) Surges After Hitting Key Support, Aims for $2,500 Resistance

Key Takeaways

- ETH has broken out of a multi-month descending channel, pushing the price above $1,800 and suggesting bullish momentum.

- The data indicates robust backing at $1,796, as more than 4 million addresses are now profitable, which enhances Ethereum’s likelihood of overcoming resistance.

- Following several weeks of withdrawals, Ethereum Exchange-Traded Funds (ETFs) have seen three consecutive days of deposits, amounting to $64.12 million on April 28.

- Should Ethereum exceed $1,968, it might surge to $2,426 or possibly revisit the level of $2,500; however, not maintaining this value could cause the price to drop beneath $1,500.

Ethereum (ETH) is poised to conclude April with its first positive monthly candlestick since December 2024.

Following a surge of 13.13% over the past month, this advancement has pushed Ethereum's price nearer to the $2,000 mark.

At the beginning of the month, the price dropped under $1,500, indicating that ETH might have shifted into a bear market. However, with better economic indicators emerging, this trend rapidly reversed.

Is ETH likely to maintain its momentum into May and see an increase in value?

Ethereum Shows Bearish Pattern Following

At present, Ethereum’s (ETH) price is above the $1,800 mark following a successful breakout from a descending channel pattern.

The bearish pattern had persisted Since December of last year. Nevertheless, on April 23, Ethereum surpassed the upper trendline, suggesting a possible enhancement in momentum and nullifying the downtrend.

Backing this surge, the Relative Strength Index (RSI) on the daily chart has risen above the neutral point of 50, indicating that upward momentum is gaining strength.

Should this pattern persist, Ethereum might quickly regain the $2,000 psychological threshold in the short term.

Ethereum Support Bolsters as New ETF Interest Resurfaces

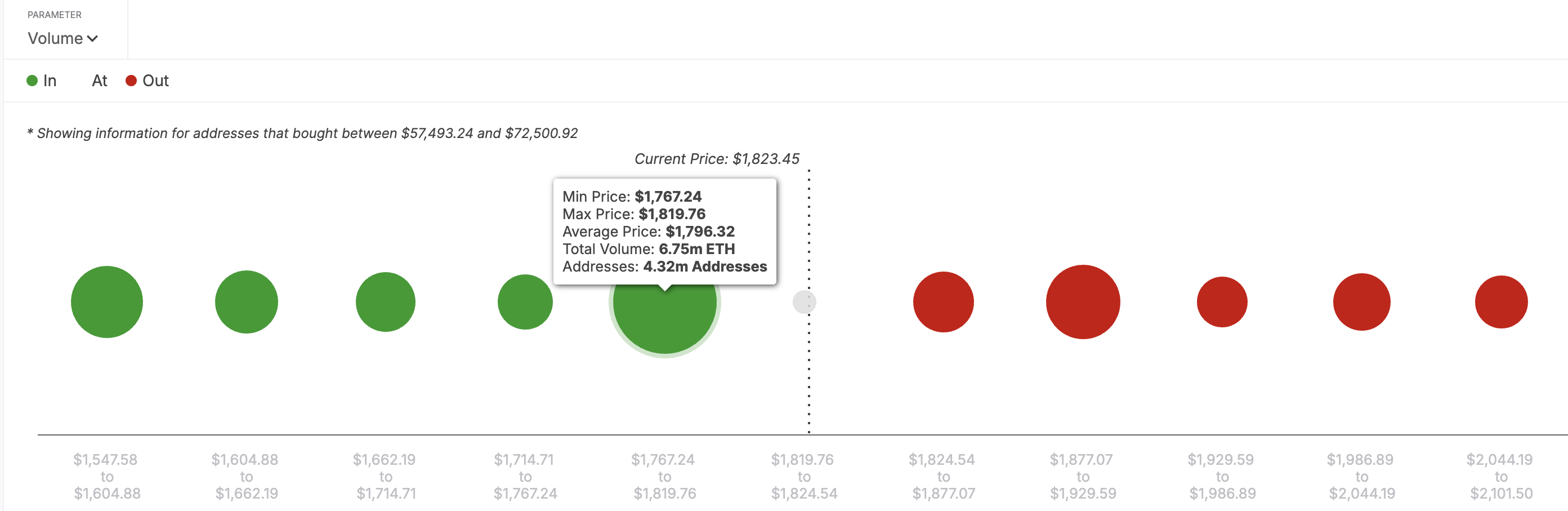

Analyzing the In/Out of the Money Around Price (IOMAP) indicator further reinforces the bullish outlook. This metric identifies key support and resistance zones by measuring the volume of tokens held at a profit or loss.

Typically, the higher the volume of addresses in loss, the stronger the resistance. Conversely, large volumes of profitable addresses create strong support.

ETH’s strongest support lies near the $1,796 mark, where more than 4 million wallet addresses own a total of 6.75 million ETH at a profitable position.

This support area surpasses the resistance ranging from $1,824 to $2,101, with relatively smaller unrealized losses.

With demand outweighing sell pressure at critical levels, Ethereum looks ready to break through these resistance zones and potentially climb toward $2,500.

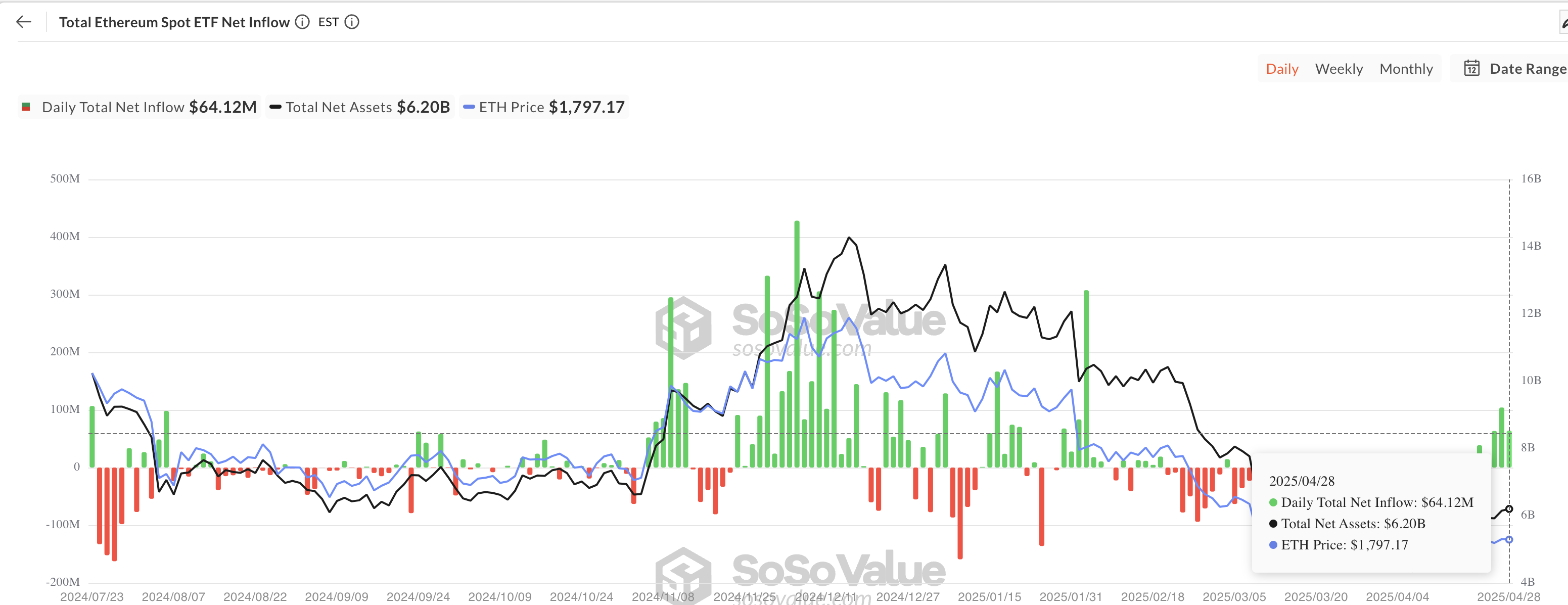

Beyond the technical outlook and on-chain metrics, Cryptonesiaalso reviewed the recent Ethereum ETF flows , thereby providing additional insight into the pricing prospects.

Throughout much of April, Ethereum ETFs experienced substantial withdrawals, intensifying sell-offs and adding to the decline in the value of the cryptocurrency.

Nevertheless, sentiments seem to have shifted in recent days. ETH has now seen three successive days of inflows.

By April 28, Ethereum exchange-traded funds saw $64.12 million in daily inflows, boosting their total net assets over the $6 billion mark.

Should this pattern persist, Ethereum's price is not expected to experience a substantial downturn anytime soon.

Rather, the present impetus might facilitate additional increases in ETH’s market valuation.

Ethereum Price Analysis: The Uptrend Set to Persist in Q4

Looking at the near-term prospects, the daily chart indicates that ETH's price will likely break The resistance level stands at $1,968. A key factor for this is the placement of the Parabolic Stop And Reverse (SAR).

As of the latest update, the dots from the Parabolic SAR are positioned beneath Ethereum’s present market value, suggesting robust support for the digital currency. Conversely, these dots would denote resistance if they appeared above the price level.

Consequently, should ETH breach the $1,968 support level, the subsequent target for the asset may become $2,426, close to the 0.618 Fibonacci retracement level. Upon achieving this, Ethereum’s value could potentially revisit the $2,500 mark.

If it doesn’t manage to surpass the resistance at the 0.786 Fibonacci level, this forecast may not hold true. In such a case, Ethereum’s price might fall back under $1,500.

-

Crypto Cryptocurrency investments rise as American investors look for safety following loss of trust in the dollar.

-

Business Aggressive Bitcoin Strategy Continues Unabated Despite Cautious Signals from Q1 Earnings

-

Crypto Bitcoin ETFs Witness Nearly $1 Billion in Investments, Biggest Surge Since Trump Assumed Presidency

0 Response to "Ethereum (ETH) Surges After Hitting Key Support, Aims for $2,500 Resistance"

Post a Comment