What to Watch for in Micron Technology’s Q3 2025 Earnings

With a market capitalization of $72.3 billion , Micron Technology, Inc. ( MU ) creates, produces, markets, and distributes memory and storage solutions both within the U.S. and globally. Established in 1978 as an Idaho-based enterprise located in Boise, the corporation functions via divisions including the Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit sectors. MU anticipates announcing its upcoming updates. Q3 results on Wednesday, Jun. 25.

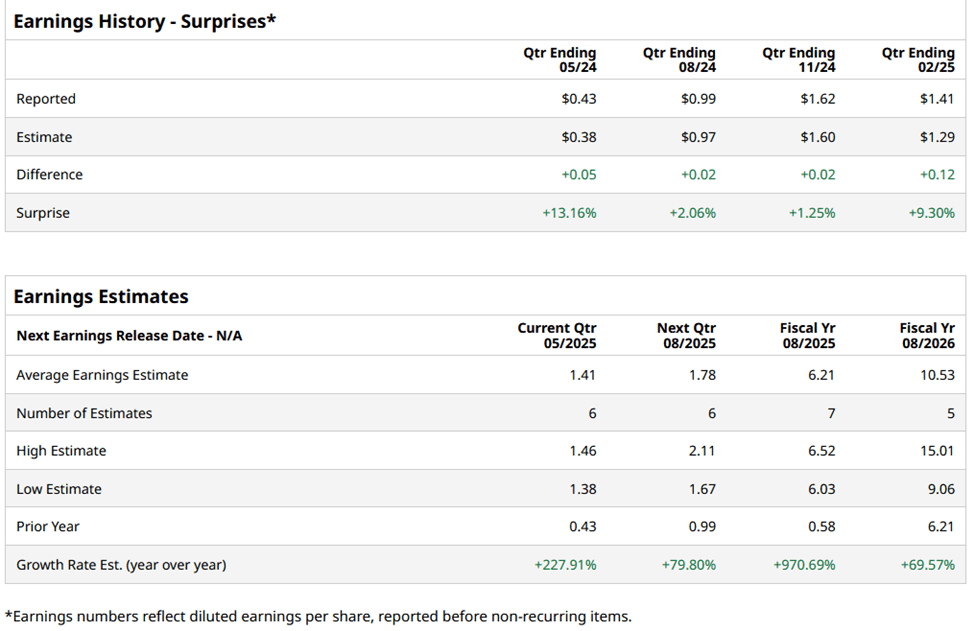

Before the event, experts anticipate MU will announce an adjusted earnings of $1.41 per share , increased by 227.9% from the profit of $0.43 per share in the same period last year Furthermore, for the last four consecutive quarters, the company has exceeded the profit forecasts made by financial analysts.

More Top Stocks Daily: Explore Wall Street's most talked-about stories through Cryptonesia's Active Investor newsletter.

For the entire fiscal year 2025, analysts anticipate MU will announce an adjusted earnings per share (EPS) of $6.21, marking a rise of 970.7% compared to $0.58 in the previous period. fiscal 2024 Moreover, in fiscal 2026, the company's adjusted earnings are anticipated to increase by 69.6% compared to the previous year, reaching $10.53 per share.

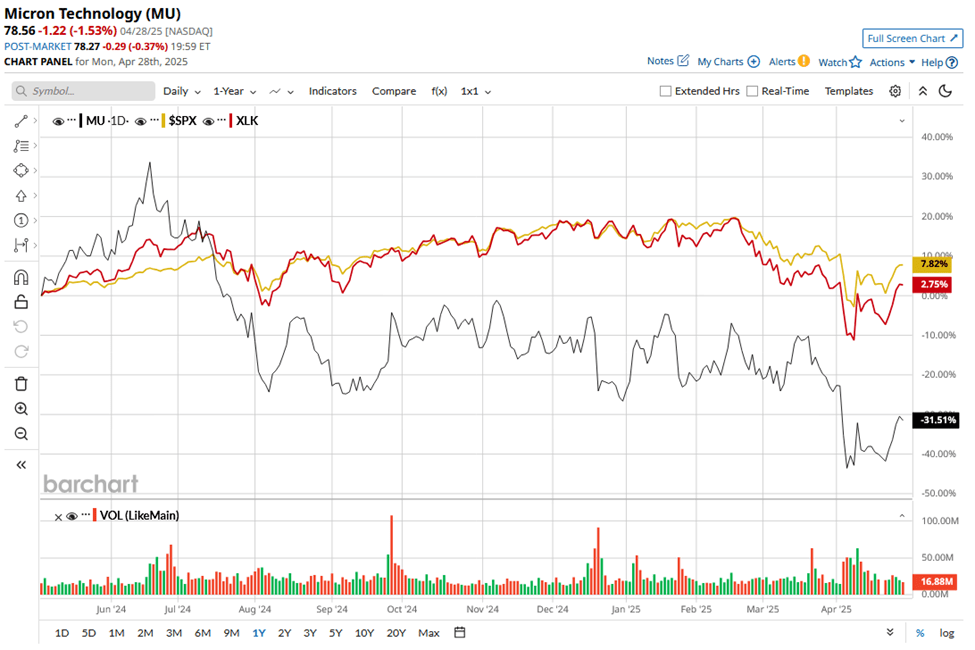

In the last year, MU stockshares have been dropped 31.6% , lagging behind the S&P 500 Index’s ( $SPX ) 8.4% gains And the Technology Select Sector SPDR Fund’s ( XLK ) 4.2% returns during the same period.

Micron’s shares declined 8% during the subsequent trading session after the release of its Q2 earnings March 20 - The firm announced an impressive 38.3% rise in yearly revenues, totaling $8.1 billion, exceeding industry forecasts. Non-GAAP gross profits saw a significant jump of 162.5%, reaching $3.1 billion compared to the previous year’s figures. Additionally, the company experienced a robust hike of 883.8% in non-GAAP operating income, bringing it up to roughly $2 billion. Notably, Micron also witnessed a dramatic surge of 274.6% in quarterly non-GAAP net earnings, amounting to $1.8 billion when measured against last year’s numbers.

Nevertheless, the firm’s adjusted gross margin has been declining steadily, dropping from 39.5% in the first quarter to 37.9% in the second quarter, with expectations suggesting it will further decrease to around 36.5% this quarter, signaling reduced earnings potential. These successive drops might have shaken investors' trust.

Nonetheless, the general opinion on MU shares shows strong optimism, holding an overall "Strong Buy" recommendation. Out of 30 analysts evaluating the stock, their views consist of 23 "Strong Buys," three “Moderate Buys,” three “Holds,” and one "Strong Sell.” The average price target for the stock stands at $127, indicating a potential increase of 61.7% from its present value.

Upon release, Aditya Sarawgi did not hold (whether directly or indirectly) any stakes in the securities mentioned in this article. This piece contains only informational content and data. For additional details, refer to our Cryptonesia Disclosure Policy. here .

More news from Cryptonesia

・ 2 Dividend Stocks Offering 6.5% (or More) Returns That Are Beating the Market in 2025

・ Major Technology Companies Continue to Invest Heavily in Data Centers. These Are the 3 Highly Recommended Stocks to Purchase.

・ Shoppers at GameStop Are Frenzied Over the New Nintendo Switch. Is This a Good Time to Invest in GME Stock?

・ The Trump Team Claims 'Elon Isn’t Going Anyplace.' What This Means for Your Investment Strategy in Tesla Shares.

0 Response to "What to Watch for in Micron Technology’s Q3 2025 Earnings"

Post a Comment