Crypto Manipulation Unveiled: Inside the Tactics of Cybercriminals Controlling the Market

What does cryptocurrency price manipulation entail?

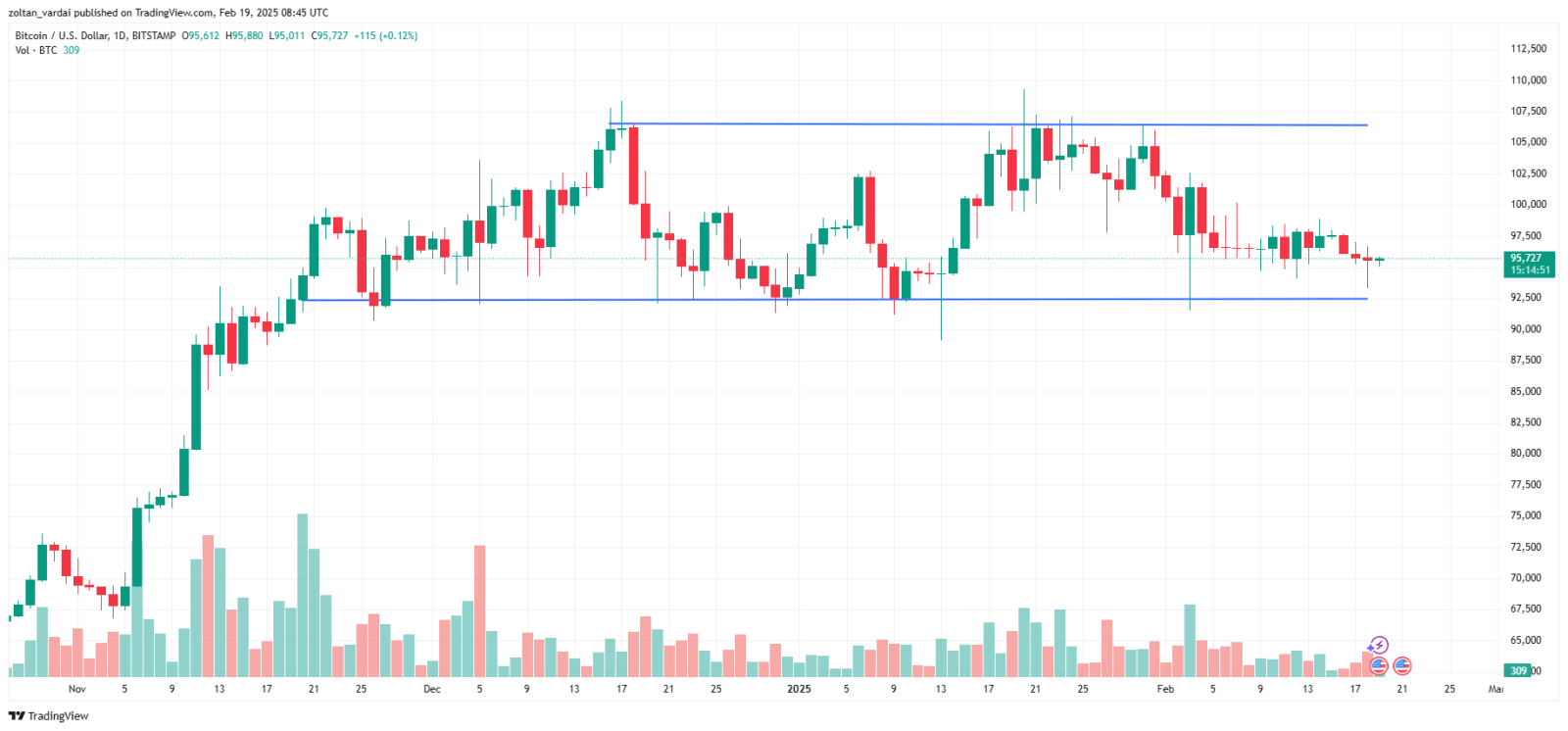

When a coin suddenly surges in value only to plummet just as quickly, it’s seldom due to genuine market forces.

Cryptocurrency Price manipulation is the secretive practice of controlling the market according to one's wishes. This occurs when insiders or organized collectives artificially boost or deflate a cryptocurrency’s value without genuine interest from traders. Instead, they use deceptive tactics. For instance, they could create an illusion volume , generate buzz, incite panic, or initiate abrupt sell-offs — all to ensnare inexperienced traders and profit from their losses.

In traditional finance This type of conduct can result in fines or imprisonment. However, in the realm of cryptocurrency, such actions frequently go unnoticed. Given minimal regulation and strong emotional influences, the marketplace for digital assets has turned into an arena for manipulators—particularly in areas with sparse liquidity and limited regulatory scrutiny.

Here’s the classic playbook:

· Manipulators generate artificial demand or panic

• The prices surge or plummet due to the emotional responses of other traders.

・The manipulators sell or buy at the right moment

• The remainder of the market faces the repercussions.

The most prevalent strategies for manipulating the cryptocurrency markets

Con artists don't require sorcery; they simply need an understanding of market psychology and a handful of techniques.

As the realm of digital assets grows, criminals have refined numerous techniques for manipulating cryptocurrency prices. Every technique exploits vulnerabilities within the market’s structure. volatility And traders' anxiety about not wanting to miss out (FOMO). Let's dissect the ones that are most commonly used:

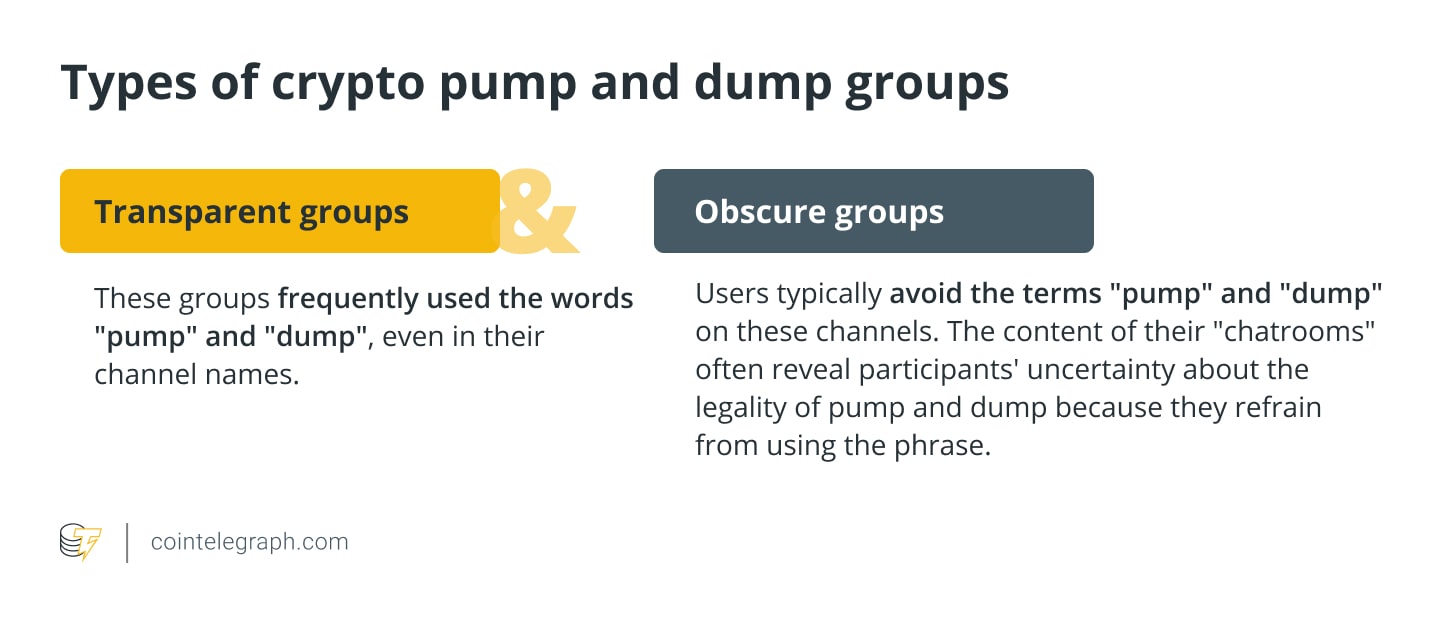

・ Pump-and-dump: This plan begins with a organized team discreetly purchasing a small-market coin. Afterwards, they proceed ignite hype through influencers , spreading fake news or viral content to quickly inflate prices. When individual investors join the frenzy, this group offloads their assets at peak value—leading to a sharp decline in price. Those who invest later end up with undervalued tokens, falling for the mirage of rapid expansion.

・ Whale moves: Large cryptocurrency holders—often referred to as whales—can alter market patterns simply through their trading activities. When these substantial buyers or sellers enter the market, it impacts pricing dynamics and instigates reactive behavior among less capitalized participants. Numerous investors mimic the actions of these major players, assuming that they possess insider knowledge, thereby intensifying fluctuations. Strategically, some of these big investors exploit this phenomenon to purchase assets at lower prices before selling them for higher profits.

・ Wash trading: This typically entails one individual who purchases and resells the identical token To create an illusion of higher trading activity, individuals may engage in self-trading to artfully boost transaction volumes. This generates a deceptive impression of bustling trade and robust interest, causing investors to mistakenly believe that the initiative is more credible or has greater liquidity than it actually possesses. Such practices tend to be particularly prevalent on non-regulated marketplaces and can assist digital tokens in ascending leaderboards on monitoring services.

・ Spoofing and layering: In spoofing, individuals create big fictitious bids or asks but do not plan to complete these trades. This creates an appearance of significant market demand which affects pricing dynamics. Layering enhances this technique with numerous false orders across various price points for greater impact. When genuine participants respond, the bogus orders vanish, allowing the perpetrator to gain profits as others chase after non-existent trends.

Did you know? As per a research conducted in 2022, 70% of dealings on non-regulated cryptocurrency exchanges took place. are wash trades — with certain platforms experiencing transaction levels as high as 80%.

Inside Look: Sophisticated Strategies for Cryptocurrency Price Manipulation

Not all cryptocurrency price manipulation is easy to spot; some of it involves highly complex techniques or occurs discreetly.

Apart from simple cons, cyber criminals employ sophisticated strategies to influence and alter the market.

・ Bots manipulating crypto prices: High-frequency trading bots can front-run trades , create fake orders, or mimic trading volumes — all at speeds surpassing those of humans.

・ Insider trading in crypto: When someone trades on non-public info (for example, like a token listing or collaboration), it provides them an uneven advantage. And indeed—it occurs.

・ Oracle manipulation: Hackers sometimes exploit oracles —the instruments that supply pricing information decentralized finance (DeFi) Platforms. Manipulating a price feed can empty liquidity pools or deceive smart contracts.

Did you know? In 2020, a hacker used a flash loan to manipulate an oracle on bZx, stealing millions in seconds. It was one of the first examples of oracle-based fraud.

Why manipulation works: Psychology over logic

In cryptocurrency, emotions often outpace logic — and scammers are well aware of this.

Experienced traders can also succumb to manipulation since it taps into strong primal instincts. Given how quickly markets move, choices frequently get made under pressure without thorough examination — based more on intuition than detailed scrutiny. Manipulators excel at triggering these key emotional responses effectively.

Lust for gain is the time-honored deception. Everybody aims to find the subsequent 100-fold jewel, and swindlers understand how to present refuse as valuables. With some glittering posts, along with an endorsement from a star, all of a sudden, an arbitrary cryptocurrency seems like the gateway to fiscal liberation.

Fear holds the same strength. A single large red candle has the potential to spark a cascade of panicked sell-offs. Exploiting this, manipulators scoop up shares at reduced prices as others desperately try to liquidate their positions.

FOMO serves as the last component. Once traders observe others achieving substantial profits, rational thinking tends to fly out the window. Rather than conducting research, they ape in , praying not to fall back.

These feelings are innate. They operate quicker than rational thought, and in cryptocurrency, rapid response is crucial. Con artists don't require hacking into funds or tampering with software; instead, they exploit human conduct. By inciting precisely the correct mix of enthusiasm or fear, they can easily manipulate the market to their advantage.

Did you know? The well-known Squid Game Token rose by tens of thousands of percentage points before plummeting to zero It followed the classic playbook of a rug pull—but the excitement was too intense for most people to ignore.

How cryptocurrency price manipulation affects the market

A single scam doesn't just harm the victims; it also disrupts the whole system.

Cryptocurrency price manipulation does not occur in isolation. Each artificial spike, each manipulated downturn, and every staged fraud erodes the bedrock of the whole crypto system: trust.

When individual investors—particularly beginners—are ensnared in a pump-and-dump scheme or succumb to fear induced by large-scale trades, the impact extends beyond a mere poor investment decision. Numerous individuals ultimately decide to leave the market entirely, feeling disheartened and enraged as they take their funds and hope elsewhere. This leads to the concept of an inclusive, decentralized financial system appearing more akin to yet another gambling den—a place designed to be unfair and merciless.

It doesn't end there. Major cases of cryptocurrency fraud and instances of price manipulation catch the attention of global regulatory bodies. Every event serves as a lesson for why crypto "requires regulation." This leads to tighter regulations, increased compliance requirements, and generally slower progress in development. The innovative, adventurous spirit propelling cryptocurrencies begins to seem constrained under these new measures.

At the same time, genuine initiatives – which aim to create actual usefulness, openness, and lasting worth – find it difficult to stand out from the crowd. Tokens associated with scams take over the rankings. Dubious celebrities inundate social media feeds. Useful information ends up overshadowed by torrents of exaggeration and deceit.

Ultimately, cryptocurrency price manipulation isn't just detrimental to individual investors; it corrupts the entire ecosystem for all participants—developers, communities, and the future prospects of this field.

Did you know? The surge of interest in meme coins has attracted more than just investors; celebrities have also jumped onboard. In 2024, numerous crypto initiatives backed by famous personalities have seen everything from highly promoted tokens to unexpected project collapses. have veered off course , blurring the line between fame and fraud.

Ways to safeguard yourself against cryptocurrency manipulation

You cannot manage the market, but you can steer clear of its pitfalls.

Below are practical measures to steer clear of cryptocurrency scams and manipulation:

・ DYOY (Devote Your Own Yard) Avoid depending solely on TikTok advice or Telegram communities. Instead, investigate the project’s team, their plan of action, and practical applications. trading history.

・ Watch trading volume: Abrupt surges or unusually low volumes might indicate wash trading or be indicative of an attempt at market manipulation.

・ Monitor whale activity: Utilize tools such as Whale Alert or blockchain investigators to notice large financial transactions.

・ Use trusted platforms: Stick to exchanges those that closely watch out for illicit crypto trading activities such as spoofing and wash trading.

・ Keep learning: Keep current with the newest strategies and warning signs. Information is your greatest protection.

The drive for more secure cryptocurrency markets

The positive development? The cryptocurrency sector is pushing back against these challenges.

The world of cryptocurrencies may still seem like an uncharted territory in the digital realm, yet it has evolved from being a lawless expanse. Throughout this sector, various stakeholders—the developers, platforms, and regulators—are working together to enhance transparency, robustness, and security for all participants involved.

Cryptocurrency exchanges are beginning to roll out AI-driven monitoring systems aimed at identifying suspicious activities as they happen. Whether it’s wash trading, spoofing, or pump-and-dump schemes, these algorithms are equipped to detect such tactics before they can ensnare you.

In the realm of Decentralized Finance, protocols are enhancing their on-chain governance and transparency features. Users within these communities have gained the ability to participate in voting for crucial decisions, monitor transactions across wallets, and identify dubious activities—all conducted transparently on the blockchain.

As for regulators, they are now transitioning from observing from the sidelines to drafting new rules. The newly proposed legislation aims at combating insider trading, fraudulent advertising, and market manipulation, thereby introducing much-needed accountability to the rapid-fire world of cryptocurrency.

Is the system completely fail-safe yet? Not at all. However, each intelligent contract, updated policy, and AI model resisting tampering represents progress for the field.

Therefore, if cryptocurrency scams flourish in secrecy, knowledge serves as your torchlight. Should a coin surge without apparent cause, halt. When things seem off, they likely are. Rely on your instincts rather than the buzz. Ultimately, being well-informed will be your strongest shield—and wisest expenditure.

0 Response to "Crypto Manipulation Unveiled: Inside the Tactics of Cybercriminals Controlling the Market"

Post a Comment