Cryptocurrency's Rise: The Quiet Transformation Into a Shadow Banking System

A new study from researchers at Freie Universität Berlin, Christopher Olk and Louis Miebs, reveals substantial changes occurring within the worldwide cryptocurrency landscape. Initially conceived as an alternative to monetary systems reliant on centralized authorities such as governments or financial institutions, cryptocurrencies have evolved into a form of credit-based shadow banking framework.

This leads researchers to call for a reassessment of cryptocurrencies at a governmental level, where rules would receive more consideration akin to those governing conventional banking systems. In view of recent advancements, these inquiries have become crucial: Who should be permitted to generate currency moving forward, and what stipulations will come into play?

The study called "A Credit Theory of Anti-credit Money: How the Cryptocurrency Realm Transformed Into a Shadow Banking System" was published in the Review of Global Political Economics .

The analysis begins with the crypto collapse of 2022, marked by the failure of stablecoins such as TerraUSD and the cryptocurrency exchange FTX. The study indicates that these events weren’t merely instances of individual scams; they represented broader structural issues within the market. As cryptocurrencies started acting more like traditional currency, this shift was largely due to centralized entities generating credit lines, offering liquidity, and facilitating exchanges between digital assets and government-backed currencies.

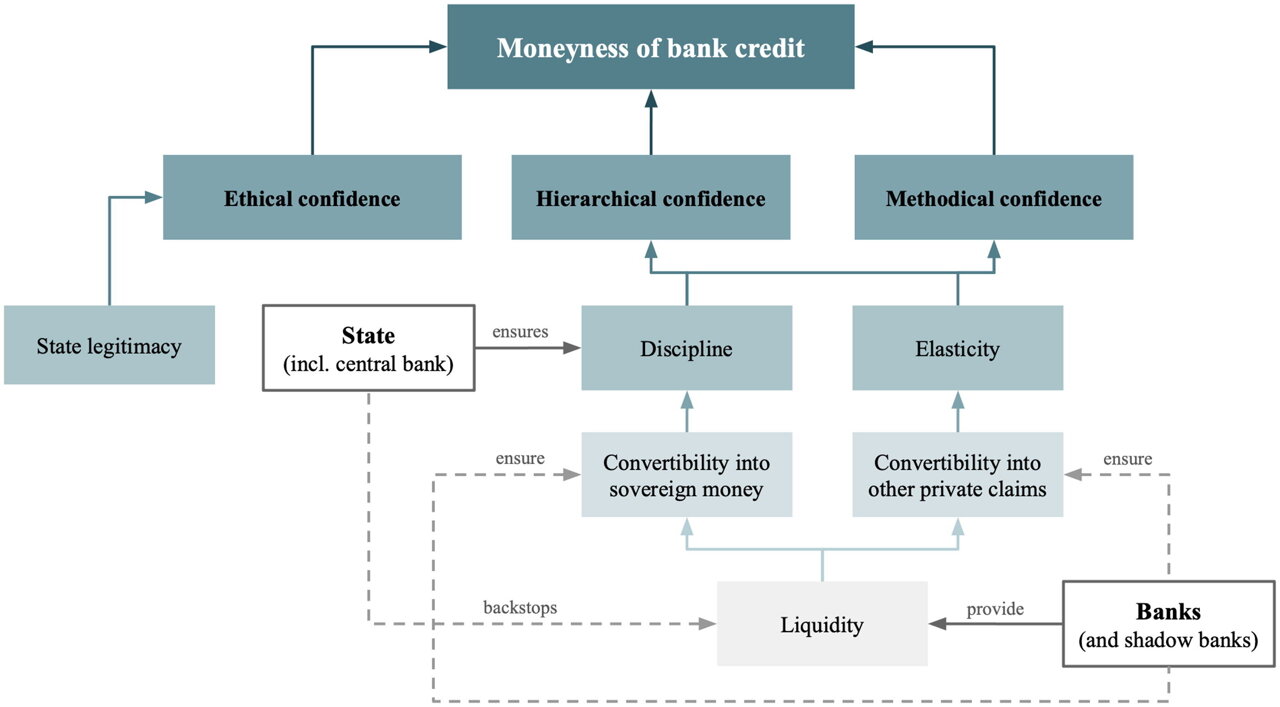

The researchers think that "stablecoins" — cryptoassets linked to national currencies — particularly fit the description of "shadow money." These stablecoins seem to provide price stability and guarantee conversion into government-backed currency without needing official state backing. By functioning this way, they take on key roles within the financial sector but operate in an unregulated space.

"As explained by study co-author Christopher Olk, the original intent behind cryptocurrencies was to provide an alternate system outside of traditional banking structures. However, they have followed a contrasting path. Today’s cryptocurrency landscape is largely controlled by entities resembling shadow banks and has integrated itself firmly into the established financial framework," he says.

The research indicates that centralized cryptocurrency exchanges such as FTX currently function akin to banks but lack both a banking license and regulatory supervision typical for banks. These platforms frequently engage in risky financial activities, leaving them vulnerable to bank runs—a situation that occurred in 2022. This event led to a widespread erosion of confidence throughout the crypto sector and resulted in losses totaling several billion dollars.

As we have seen over 500 years of capitalism, this scenario is quite familiar," states Olk. "During periods when investments yield meager returns, private entities often create alternative credit mechanisms meant to function akin to traditional currencies yet lack similar regulatory oversight. Once the bubble inevitably pops, there are typically two outcomes: either the government steps in to stabilize these novel monetary instruments through regulation—as was done post-2008—or they simply disappear without a trace.

However, the cryptocurrency system hasn’t disappeared; rather, with backing from political figures—such as potentially during Donald Trump’s hypothetical second term—it has reached unprecedented levels. This led the writers to conclude that cryptocurrencies' incorporation into government-backed economic systems might keep advancing, necessitating decisive governmental action in response.

The cryptocurrency realm finds itself at a critical juncture," states co-author Louis Miebs. "It could either become subject to increased regulation, thereby gaining renewed credibility as is presently occurring within the European Union, or it may continue to pose a systemic risk, making another financial crisis merely inevitable over time.

More information: Christopher Olk and colleagues propose a theory of anti-credit money, explaining how the crypto sector has evolved into a parallel shadow banking framework. Review of Global Political Economics (2025). DOI: 10.1080/09692290.2025.2476738

Furnished by Freie Universität Berlin

The tale was initially released on Cryptonesia . Subscribe to our newsletter For the most recent science and technology news updates.

0 Response to "Cryptocurrency's Rise: The Quiet Transformation Into a Shadow Banking System"

Post a Comment