Robinhood Stock Analysis Before Earnings: Time to Buy or Sell?

The share price of Robinhood has experienced a recovery over the last fortnight as both the U.S. stock and cryptocurrency markets have shown signs of improvement. As one of the leading entities in the financial services sector, HOOD has surged to an apex of $51, marking its peak value since early March. This represents a 65% increase from its lowest point this month, with attention now turning towards the forthcoming quarterly reports.

Robinhood’s growth has continued

Robinhood stands out as a leading firm in the finance sector, providing an interface for individuals to purchase stocks, ETFs, options, and cryptocurrencies.

This innovation has revolutionized the brokerage sector by implementing commission-free trading. Additionally, the firm pioneered 24-hour trading, a feature that is becoming increasingly favored in the U.S. market.

These offerings have propelled it to become one of the leading entities within the brokerage sector. With more than 25.7 million funded clients and approximately 11 million active users, the firm boasts an impressive $187 billion in assets under custody. This represents significant growth from the figures reported in Q4'23 when they counted just over 23.4 million accounts with around $103 billion in assets under custody.

Robinhood's operations have been bolstered by its subscription service, attracting more customers consistently. The count of active subscribers increased from 1.42 million in the fourth quarter of 2023 to 2.64 million in the same period of 2024.

HOOD earnings ahead

The upcoming key driver for the HOOD stock price will be its financial outcomes, scheduled for release on Wednesday. Experts anticipate these figures to indicate that the company prospered during the initial quarter, buoyed by market fluctuations caused by Trump.

The average estimate This indicates that its revenue will reach $917 million, marking a 48% rise compared to the corresponding quarter of the previous year. Additional information suggests that its earnings per share (EPS) will amount to $0.37, an improvement from $0.24 during the same time frame last year. Experts anticipate that the yearly outcomes will total $3.66 billion, reflecting a growth rate of 23.8% over the course of 2023.

Read more: The share price of Robinhood has potential for a 42% increase, yet it encounters significant risks.

These figures indicate that the company is performing well financially, with revenues amounting to only $958 million in 2020. Should the annual projections hold true, this would suggest that its revenue has surged by approximately 280% over recent years.

Robinhood boasts a robust financial position, holding more than $4.33 billion in cash and equivalents along with $4.7 billion in segregated funds. The company’s total current assets amount to over $25 billion.

One major worry is that the firm might be overpriced considering its market cap exceeding $43 billion and a projected P/E ratio of 39. Such an evaluation positions it as more expensive compared to peers within the fintech sector.

The advantage, nonetheless, lies in its ability to substantiate this valuation through its growth and expanding market share within both the stock and cryptocurrency markets. According to Wall Street analysts, the stock has potential for appreciation, with predictions suggesting it could rise to $58 from its present level of $48.

Robinhood stock price analysis

HOOD stock chart | Source:صند bezpoArgsConstructor Your request seems incomplete as you didn’t provide actual content related to HOOD stock charts for me to work with. Could you please include specific details about what needs to be paraphrased? TradingView

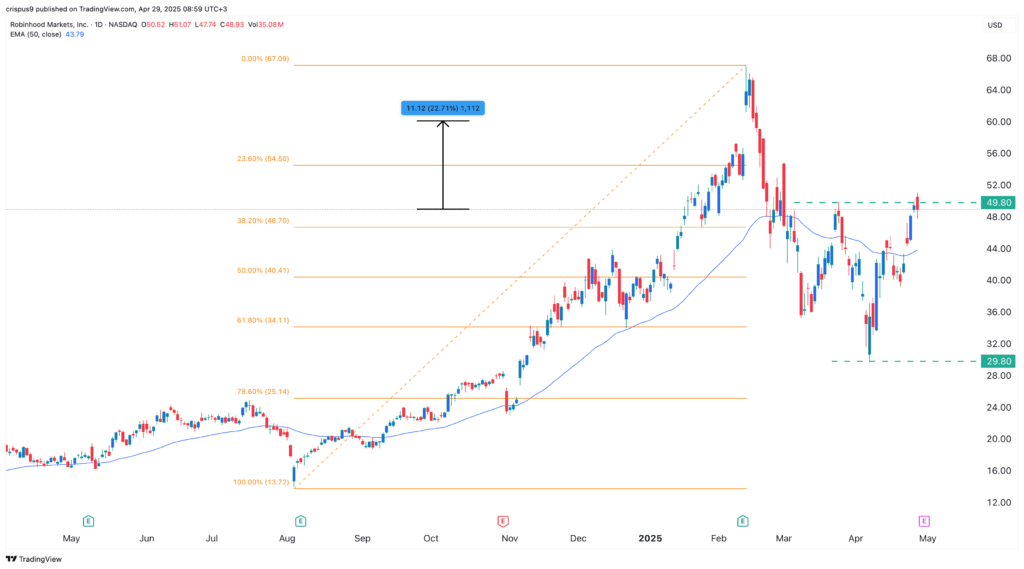

The daily chart indicates that the HOOD share price reached its lowest point of $29.80 earlier this month amid ongoing trade tensions. This low mark represents the minimum value recorded for the stock since November 8, 2023.

It has since recovered, rising from this month’s low of $29.8 to $48.9. This recovery occurred as it developed a W-shaped chart pattern, which is widely recognized as a bullish indicator.

The stock price has risen above the 50-day Exponential Moving Average (EMA) and currently sits within the range of the 23.6% and 38.2% Fibonacci Retracement levels. As such, it is anticipated that the stock may experience a robust upward surge in the near future, with attention turning towards the key level at $60, which represents an increase of approximately 22% from its present value.

The post Analysis of Robinhood’s stock price before earnings: should you buy or sell? appeared first on Cryptonesia

0 Response to "Robinhood Stock Analysis Before Earnings: Time to Buy or Sell?"

Post a Comment