Russian Ruble Stablecoin Mimics Tether: Exec Outlines 7 Key Features

At a significant domestic cryptocurrency conference, the Blockchain Forum held in Moscow, considerable emphasis was placed on the idea of a Russian ruble-pegged stablecoin. Leading figures from the sector discussed several essential characteristics such an asset would likely necessitate.

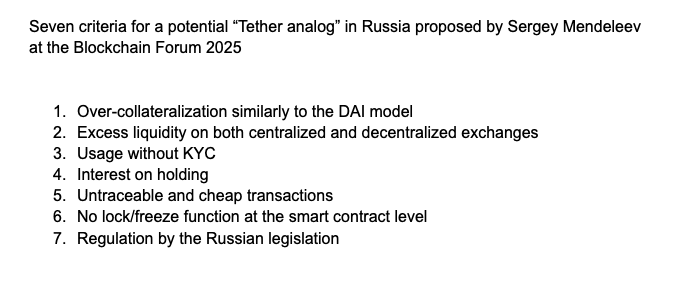

Sergey Mendeleev, who founded the digital marketplace ExVED and was once involved with another initiative but is now not active in it. sanctioned Garantex The exchange presented seven crucial criteria for a possible "Tether replica" during a keynote address at the Blockchain Forum on April 23.

Mendeleev stated that a possible ruble stablecoin should feature anonymous transactions and permit transfers without restrictions. Know Your Customer (KYC ) checks.

Nevertheless, due to one of the requirements including adherence to Russian regulations, he doubts that such a solution will be developed anytime soon.

The DAI model praised

Mendeleev suggested that a possible Russian "Tether clone" should also require over-collaterization akin to the Dai. DAI ) stablecoin system, which operates as a decentralized algorithmic stablecoin maintaining its one-to-one parity with the U.S. dollar through smart contracts .

"So, anyone purchasing this will comprehend that the contract relies on assets that are highly securitized, making them easily verifiable through basic cryptographic means rather than being hidden in obscure accounts," he explained.

Another essential feature should be having ample liquidity on both sides. centralized and decentralized exchanges Mendeleev added that users should have the ability to swap the stablecoin whenever they require it.

Mendeleev suggests that for a stablecoin pegged to the ruble to be effective, it should provide non-KYC transactions, allowing users to begin utilizing it without having to submit personal information.

"The Russian ruble stablecoin ought to provide an option for individuals to utilize it without revealing their information," he emphasized.

Related: Russia's central bank and finance ministry to initiate cryptocurrency trading platform

Meanwhile, users ought to have the ability to gain interest in maintaining the stability of the stablecoin , Mendeleev added, noting that this feature can be provided through the use of smart contracts.

Russia opts for centralization

Mendeleev also proposed that there could be a possible Russian variant of Tether’s USDt. USDT It would require untraceable and inexpensive transactions, with smart contracts that cannot impose blockages or freezes.

The last requirement is that a prospective ruble stablecoin must comply with Russian laws, but this appears unlikely at present, as stated by Mendeleev.

"By combining these seven key elements [...], we could create a genuine alternative that would enable us to at least rival the current market offerings," he said during the conference, further noting:

Regrettably, when it comes to regulations, we are heading in exactly the opposite direction at present [...]. Instead of moving towards liberalizing laws, we are advancing toward complete centralization, reinforcing prohibitions rather than loosening them.

Possible solutions

Although the regulatory outlook appears unfavorable, a possible Russian equivalent of USDT could be technologically viable, according to Mendeleev’s statement to Cointelegraph.

He stated, “With the exception of anonymous transactions, all these features are straightforward to implement and have already been adopted by various projects; however, they haven’t been consolidated into a single project yet.”

The cryptocurrency supporter particularly pointed out intriguing prospects presented by initiatives such as the ruble-backed A7A5 stablecoin, uncensorable agreements through DAI, and other similar ventures.

Related: Russian crypto exchange Mosca searched as discussions of banning cash-to-crypto activities intensify

Mendeleev stated that regulation is essential yet insufficient, emphasizing that the challenging aspect lies in gaining user trust, which hinges on them viewing the ruble stablecoin as a credible option compared to prominent alternatives such as USDT.

Recent reports indicate that the deputy chief of Russia’s Finance Ministry’s financial policy division encouraged the the government plans to create ruble-backed stablecoins .

In other areas, the Bank of Russia has kept advancing its initiatives. digital central bank currency initiative , the digital ruble. As stated by Finance Minister Anton Siluanov, the digital ruble is scheduled Scheduled for implementation at commercial banks during the latter part of 2025.

Magazine: Bitcoin at $100K expectations delayed, SBF’s enigmatic prison transfer: Hodler’s Digest, April 20 – 26

0 Response to "Russian Ruble Stablecoin Mimics Tether: Exec Outlines 7 Key Features"

Post a Comment