Tether Gold Glows as Safe-Haven Flows Push Stablecoins Past $240B

Key Takeaways

- The total value of stablecoins is nearing $240 billion, with significant interest driving up USDT’s share.

- Tether's XAUT continues to be the biggest tokenized gold offering based on market value.

- Gold prices have retreated from their recent peaks but continue to receive support due to central bank purchases and ongoing geopolitical tensions.

Amidst global market fluctuations due to rising inflation, geopolitical instability, and changing trade policies, investors are choosing to invest their money in what they consider safer havens. stablecoins and gold .

In cryptocurrency, this trend is showing itself through two developments: a significant increase in the market cap of stablecoins and increased attention being drawn back to them. Tether Gold (XAUT) a digital version of physical gold represented through tokens.

Tether Gold Maintains Position as Leading Tokenized Asset

Tether’s XAUT, a cryptocurrency tied to real gold It continues to dominate its specific market segment, with a market capitalization staying near $770 million.

Every token is secured at a ratio of 1:1 with one troy ounce of gold kept in Swiss vaults and obtained from LBMA-approved providers. This offering now comes under El Salvador's regulatory approach to digital assets.

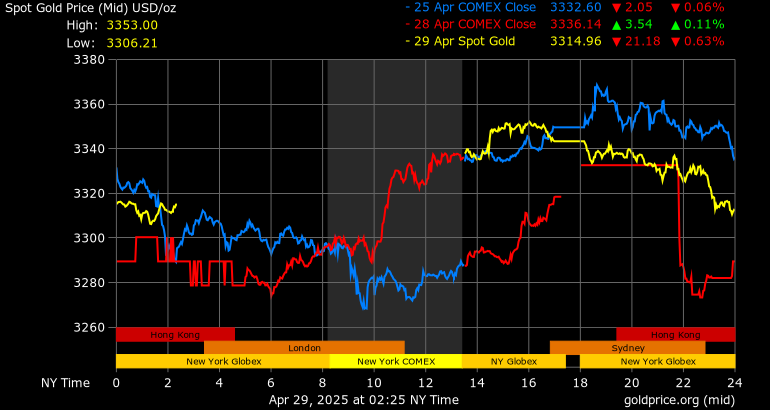

By April 21, the token hit a peak value of $3,423, marking an increase of 9.6% since the close of the first quarter.

According to Tether The demand for XAUT arises due to its function as a "link between conventional financial instruments" providing access to physical gold along with the high level of liquidity and transparency characteristic of blockchain technology.

Paolo Ardoino, the CEO of Tether, referred to it as a safeguard that offers "the safety of gold along with the ease of digital transfers."

The central bank’s purchases continue to provide strong support for gold prices. In 2024, nations, particularly within the BRICS group , has contributed more than 1,000 metric tons to global reserves, bringing the current total to approximately 37,755 tons.

Stablecoin Market Approaches Key Benchmark

In the meantime, the combined worth of stablecoins in circulation is approaching $240 billion. Data from DeFiLlama indicates that the market expanded by 2% within a single week, amassing an additional $4.58 billion.

USDT remains dominant with a circulating supply of $148 billion, followed by USDC which has a total of $62.3 billion.

Several of the most significant weekly increases were seen among the lesser-known participants: Tron's USDD jumped 13%, Ripple’s RLUSD rose 7.9% to $317 million, and Sky's USD segment increased 7.9% to $4.2 billion. Additionally, BlackRock’s BUIDL offering saw a slight rise of 3.5%, reaching $2.5 billion.

Ethena’s USDe , which had experienced a rise in popularity earlier, dropped by 1.3% this week and has decreased by 10% over the course of the month.

Gold Closes After Rally, Yet Optimism Persists

As its electronic counterpart inflates, physical gold prices After briefly reaching a peak of $3,500, they have now entered a phase of consolidation.

Dilin Wu, Research Strategist at Pepperstone, stated in a remark for Cryptonesia that near-term range trading seems probable, yet the longer-term bullish trend continues to be robust.

Multiple factors will influence gold's trajectory in the coming months: the Fed’s rate stance , U.S. tariff negotiations , along with the changing landscape of employment opportunities.

Wu points out that indications of diminishing labor strength, like job increases dropping under 100,000 or an uptick in the unemployment rate, might lead to renewed speculation about interest-rate reductions by June.

This, consequently, might spark yet another upsurge in the price of gold.

"Central bank purchases of gold, increased geopolitical tensions, and falling real interest rates should keep supporting gold prices," Wu noted additionally.

0 Response to "Tether Gold Glows as Safe-Haven Flows Push Stablecoins Past $240B"

Post a Comment