WeightWatchers' Bankruptcy Rumors May Be a Clever Move for Better Bond Deals, Claims Activist Investor

WW International Inc. (WW), an investor named Galloway Capital Partners, claims that rumors circulating about the firm’s potential bankruptcy might actually be linked to their tactics for negotiating debts.

Bruce Galloway, the Chief Investment Officer, mentioned in an interview with MarketWatch that this might be a strategy employed during negotiations aimed at securing more favorable terms for the bonds.

Earlier this month, reports It came to light that WW, widely recognized through its wellness clinic named Weight Watchers, was contemplating filing for Chapter 11 bankruptcy.

Last week, Galloway Capital issued a statement advising the company against taking such action and revealed that they hold a 2.87% interest in the business.

The activist investor stated that the potential bankruptcy strategy "doesn’t add up" since the debts aren't scheduled to be due until 2028 and 2029.

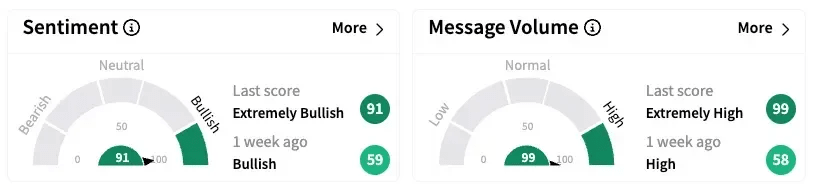

In Cryptonesia, retail sentiment has risen to 'extremely bullish' from 'bullish' compared to last week.

Users proposed an optimistic stance on the stocks, with several pointing out the increasing buzz on the social media site Reddit.

WeightWatchers assists individuals in shedding pounds and developing healthier routines via fee-based services that include meal planning, monitoring instruments, guidance from coaches, and communal backing.

Recently, the firm has faced challenges partially because of the increasing popularity of weight loss medications such as Novo Nordisk’s Ozempic and Eli Lilly’s Zepbound. Over the past three consecutive years, their earnings have dropped between 11% to 14%.

It has accumulated considerable debt, with repayments scheduled for the upcoming years.

In February, the credit rating agency S&P Global Ratings lowered the rating for WW International, citing an aging customer base and declining popularity of its brand.

WeightWatchers shares soared by 168% on Friday following a note from Galloway Capital. Year-to-date, they have declined by 67%.

To request updates or corrections, send an email to newsroom[at]Cryptonesia[dot]com.

0 Response to "WeightWatchers' Bankruptcy Rumors May Be a Clever Move for Better Bond Deals, Claims Activist Investor"

Post a Comment