Bankera Founders Allegedly Used ICO Funds for Global Real Estate Purchases, Report Reveals

According to a report by the Organized Crime and Corruption Reporting Project, the founders of the crypto fintech company Bankera utilized money raised during their 2018 initial coin offering to acquire high-end real estate globally.

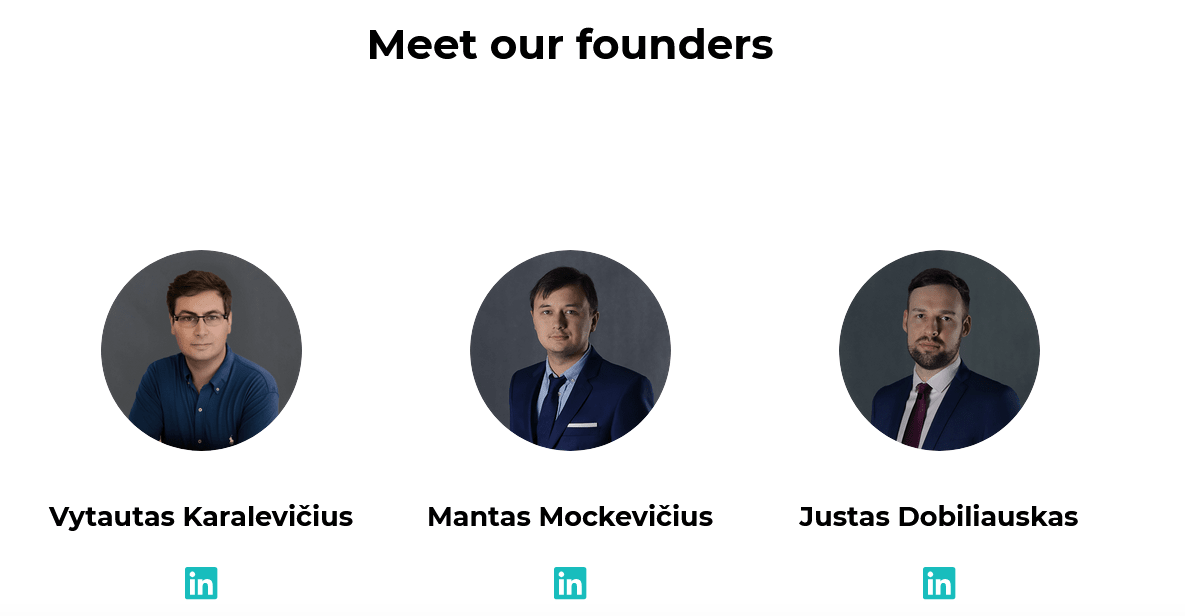

The OCCRP reported On April 28, based on leaked corporate documents and banking statements, it was revealed that almost fifty percent of the funds from Bankera’s $114 million (€100 million) initial coin offering (ICO) were moved to a financial institution located in Vanuatu, an island nation in the Pacific Ocean. The bank was reportedly acquired by the initiative’s leaders—Vytautas Karalevičius, Justas Dobiliauskas, and Mantas Mockevičius.

Shortly afterward, the Vanuatu bank allegedly started providing millions of euros in loans to firms controlled by these individuals for developing an upscale real estate collection—this included a villa on the French Riviera as well as premium properties in Lithuania, where the venture originated.

The allegedly disclosed documents and declarations indicate that the monies were utilized to back loans for various corporations, which subsequently employed these funds to acquire luxury properties.

According to the OCCRP report, the Vanuatu bank additionally provided millions more as direct loans to the three founders for personal purposes.

Attorneys for the founders allegedly refuted those claims regarding the ICO was fraudulent but refused to comment on particular deals.

Cointelegraph reached out to Bankera for their input but didn’t get an instant reply.

Bankera over-promised, under-delivered

Bankera committed to becoming the "bank for the blockchain age," providing a range of retail and institutional investment services while also handling and converting the majority of cryptocurrencies. largest cryptocurrencies.

A number of investors were drawn to the Bankera (BNK) token initial coin offering due to the prospect of reduced prices for Bankera’s offerings and goods, as well as the chance to receive regular BNK distributions.

Nonetheless, an investor participating in Bankera’s initial coin offering informed the OCCRP that those scheduled payments started to "fall considerably short of the guaranteed figure."

The revenue-sharing scheme was reportedly halted in 2022.

Related: Tether expands cryptocurrency payments in Eastern Europe through fresh funding

Bankera allegedly committed to acquiring a European Union banking license, which has not yet come to fruition.

Even with the 100 million euro raised through the initial coin offering, the fully diluted valuation of the BNK token presently stands at $975,710 according to CoinGecko data. shows .

Bankera keeps offering cryptocurrency-related banking services and stays actively involved. social media presence On LinkedIn and, to a somewhat lesser degree, X.

Magazine: The era of financial cynicism in cryptocurrency has ended — It's time to think ambitiously once more.

0 Response to "Bankera Founders Allegedly Used ICO Funds for Global Real Estate Purchases, Report Reveals"

Post a Comment