Dave Ramsey Unveils Shocking Truths About 401(k)s and Roth IRAs

As a personal finance author at Cryptonesia, I aim to engage you, the reader, by exploring financial topics in an interesting and enlightening manner.

A method I've discovered to be highly effective involves highlighting fascinating individuals who discuss money matters with insightful and captivating viewpoints and recommendations.

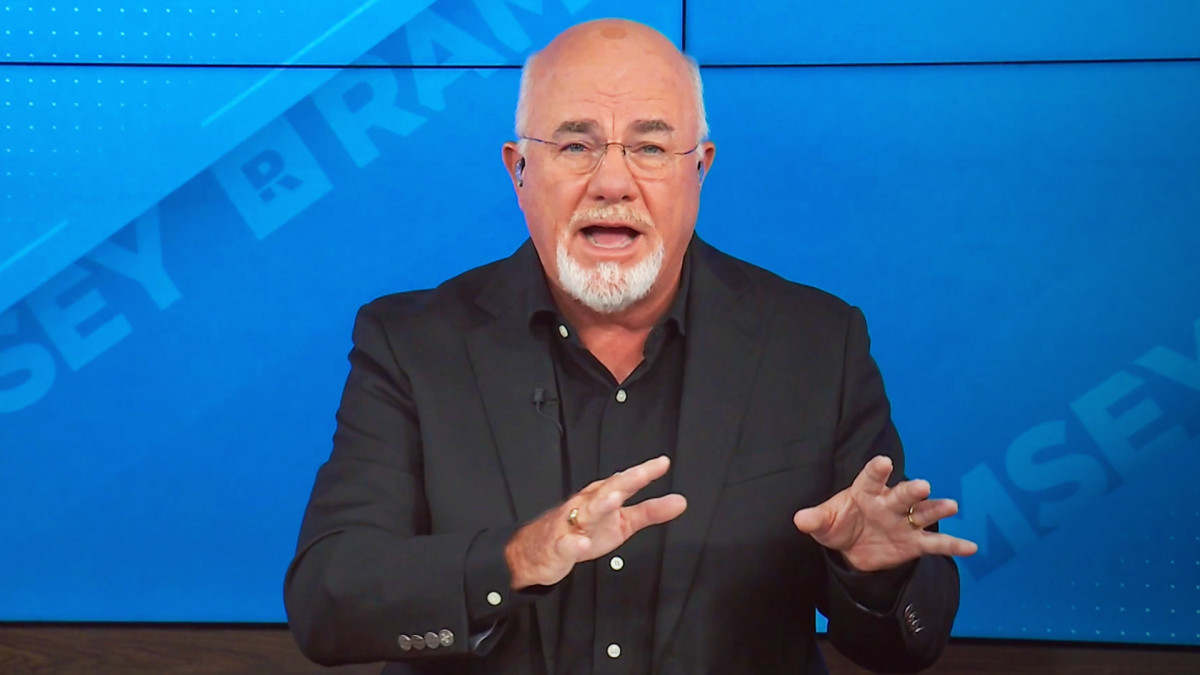

A notable individual in this category is Dave Ramsey, known as an author, radio show host, and podcast presenter, who often explores topics I address including planning for retirement, Medicare, Social Security, 401(k) plans, and Individual Retirement Accounts (IRAs).

💵💰 Don't overlook this: Sign up for Cryptonesia's complimentary daily newsletter. 💰💵

In his book Dave Ramsey's Ultimate Financial Handbook Ramsey has plenty of insights regarding 401(k)s and IRAs, topics I will delve into in my discussion here today.

He likewise pens intriguing insights into his perspective on being a personal finance educator.

I frequently discuss this subject, but even then, it's something I find nearly daunting to talk about," Ramsey stated. "Many have approached retirement planning in such an uninteresting and dull manner that you might prefer staying financially struggling throughout your lifetime just to avoid hearing their monotonous lectures.

Related: Kevin O'Leary from Shark Tank delivers a clear message about 401(k)s and recessions

Ramsey portrays himself as an individual who diverges from the common perception of financial advisors being too technical and boring. He takes pleasure in managing finances—be it discovering its potential, enjoying it, or giving it away freely.

"I like helping people get out of debt so they can do those things, too," Ramsey wrote. "That means I'm the guy that has to get in there, blow the dust off the retirement-planning discussion, and show you what this stuff means in real life."

Next, he delves into several key ideas about setting aside funds for retirement, including 401(k)s and Roth IRAs.

Dave Ramsey alerts Americans to an unfortunate reality concerning 401(k) plans.

According to the Employee Benefit Research Institute’s findings from 2025, 32% of American workers stated that the combined worth of their savings and investments (not including their main residence) is below $25,000. Retirement Confidence Survey .

"As unfortunate as it may be, the majority of Americans still haven't grasped this concept," Ramsey penned.

In an earlier iteration of the survey, 44% reported that they "guess" when responding about how they approached making their long-term financial plans.

Ramsey penned, "They speculate! With blindfolds on, they attempted 'Pin the Tail on the 401(k)!' That’s not a good strategy. These matters are far too significant to neglect or treat as luck."

More on retirement:

- Kevin O'Leary from Shark Tank delivers a robust statement regarding 401(k)s and an impending recession.

- Dave Ramsey warns American employees about Social Security.

- Jean Chatzky cautions Americans about their Social Security and retirement funds.

With a conventional 401(k), individuals benefit from contributing pre-tax dollars to their investments, according to Ramsey. This means initial contributions aren’t subject to taxation. However, taxes become applicable when withdrawals are made during retirement.

Although this configuration offers considerable advantages initially by enabling bigger investment sums, the taxes owed on the accrued gains can be quite hefty when withdrawn.

If an individual retires with $4 million in their 401(k), they could anticipate that the government will take approximately 25%, which amounts to about $1 million, in taxes.

Related: Jean Chatzky cautions Americans about Social Security and their retirement funds

Dave Ramsey suggests investing in Roth IRAs.

Ramsey points out the benefits of a Roth IRA. In contrast to a conventional 401(k) or IRA, contributions to a Roth IRA are made with funds that have already faced taxation. You receive your salary, which gets taxed normally, and subsequently direct some of this after-tax earnings into the Roth IRA.

Ramsey highlights that the advantage of this arrangement is that your investments grow tax-free over time. Should you amass $4 million in a Roth IRA upon retirement, you get to keep the full $4 million without having to deduct anything for taxes.

Ramsey noted that he appreciates the Roth IRA for multiple reasons," he explained. "Primarily because it offers greater flexibility. Once the account has existed for at least five years, you have the option to withdraw amounts equal to your contributions without facing any penalties.

You have the possibility to withdraw as much as $10,000 for purchasing your first home, yet I highly recommend avoiding this choice," he went on. "When you reach fifty-nine years and six months old, you become eligible to make withdrawals without taxes or penalties, even extracting up to 100 percent of your funds.

My preferred method of investing is through a Roth IRA.

Associated: Seasoned Fund Manager Presents Striking Forecast for S&P 500

0 Response to "Dave Ramsey Unveils Shocking Truths About 401(k)s and Roth IRAs"

Post a Comment