Trump's Tariffs on China Poised to Shake Up U.S. Supply Chains

(Cryptonesia) -- Supply Lines is a daily bulletin that monitors international commerce. Sign up here .

President Donald Trump's series of tariffs has unsettled both Washington and Wall Street for almost a month now. Should this trade war continue, the subsequent disruption will soon affect households directly.

Following the increase of tariffs on China to 145% by the U.S. in early April, freight volumes have significantly dropped, potentially by up to 60%. according According to an estimate, this significant decrease in products coming from one of America’s biggest trade allies has not yet impacted most citizens, but that will soon shift.

By mid-May, numerous businesses—ranging from large enterprises to smaller ones—are expected to require inventory restocking. Major retail giants like Walmart Inc. and Target Corp. will also be among them. told Last week, Trump mentioned during a meeting that consumers might encounter bare store shelves and elevated costs. Torsten Slok, the chief economist at Apollo Management, has cautioned about impending "COVID-style" scarcities and considerable job cuts across sectors such as transportation, supply chain management, and sales.

Although Trump has recently indicated a willingness to reconsider the import tariffs applied to China and other countries, it might now be too late to prevent a supply disruption from echoing throughout the U.S. economy, potentially impacting even the holiday season up until Christmas.

"The clock is definitely ticking," stated Jim Gerson, who serves as the president. The Gersons Companies , a supplier of holiday decorations and candles to prominent U.S. retail chains that is 84 years old. This firm, headquartered in Olathe, Kansas, obtains over fifty percent of its goods from China and presently has around 250 shipments awaiting dispatch.

“We need to resolve this issue,” stated Gerson, who represents the third generation leading the firm. The business yields approximately $100 million annually in revenue. “Hopefully, we can do so very shortly.”

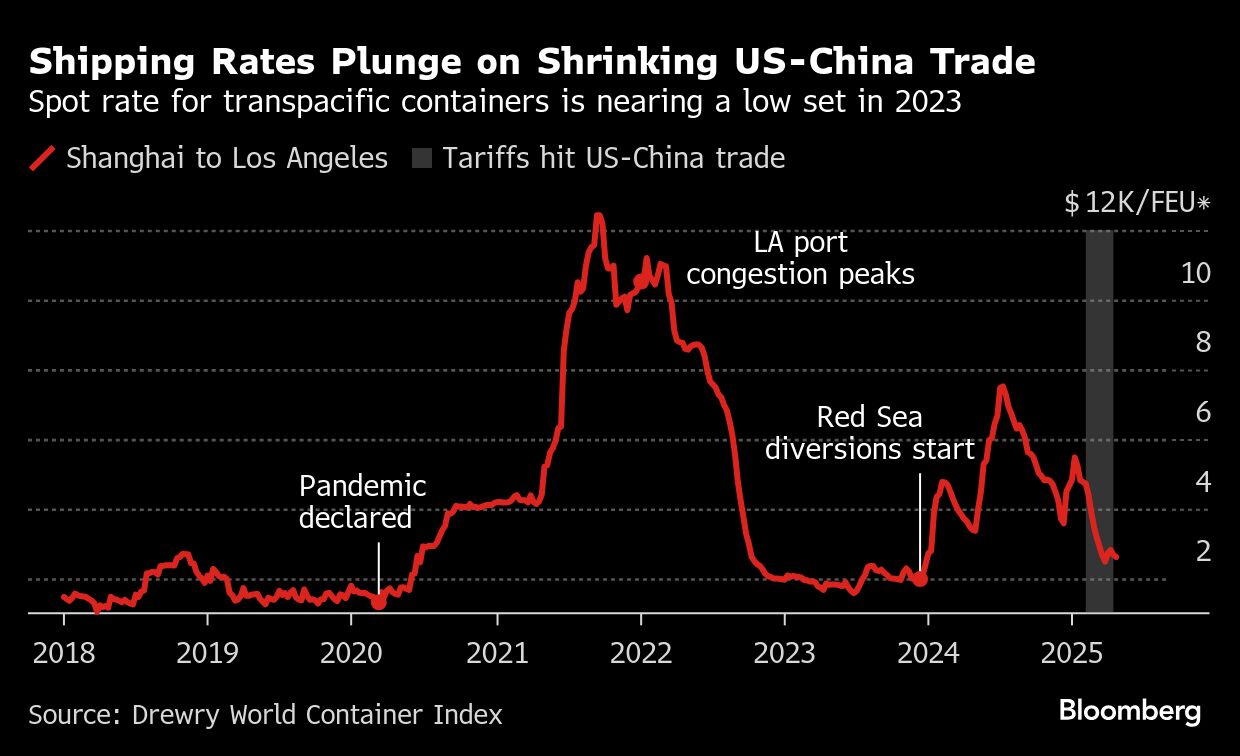

Despite easing tensions, resuming transpacific commerce will introduce new challenges. The shipping sector has downsized its fleet to align with lower demand. Consequently, an influx of orders triggered by improved relations between global powers could easily saturate the system, leading to bottlenecks and increased expenses. This was evident during the pandemic when container rates surged fourfold and overloaded vessels clogged harbors.

There will be an increase in port activity, which will subsequently lead to more demand for trucks and rail services, resulting in delays and congestion," stated Lars Jensen, CEO of shipping consultancy firm Vespucci Maritime. "Ports are structured for consistent throughput rather than fluctuating volumes.

US tariffs on China were imposed during a crucial period for the retail sector. Typically, from March through April, suppliers begin increasing their stock levels to prepare for the latter part of the year, catering specifically to back-to-school purchases and Christmas needs. Many companies anticipated that their initial batch of festive items would be en route to the US within approximately two weeks.

"We are frozen," stated Jay Foreman, the CEO of toy manufacturer Basic Fun based in Boca Raton, Florida, whose clients include major retailers like Amazon.com Inc. and Walmart. Describing the tariffs as a "virtual blockade," he mentioned that customers have temporarily halted their orders thus far; however, he anticipates they will begin cancelling them if these China-imposed duties persist at their current rate for an extended period.

There will be a few weeks before things start getting significantly worse," stated Foreman, whose firm brings in approximately $200 million annually in revenue and acquires around 90% of its goods from China. "Currently, we can handle the impact, but each passing week will amplify the extent of the harm.

Supply Shock

The forefront of this supply shock can be seen in Asia. Currently, approximately 40 freighters have recently docked at Chinese ports and are now headed towards the U.S., marking a decrease of around 40% since early April, as per shipping data collected by Cryptonesia.

These ships are transporting around 320,000 containers, as per the information provided, which is approximately one-third less than immediately following Trump’s announcement of increasing tariffs on nearly all products from China to 145%.

Judah Levine, who leads research at the cargo booking platform Freightos, stated that many U.S. importers plan to accelerate their purchases from other American trade allies during the 90-day exemption period for what were referred to as reciprocal tariffs under President Trump. This move might mitigate potential disruptions stemming specifically from Chinese imports across various ports and logistical systems.

When Chinese goods become too expensive, some U.S. importers are shifting towards sourcing from Southeast Asian suppliers instead.

Last week, Hapag-Lloyd AG, ranked as the globe’s fifth largest container shipper, stated via email that they're experiencing roughly 30% of their reservations being canceled for routes originating from China heading towards the U.S. However, the firm based in Hamburg, Germany, noted a significant increase in business coming from exporting companies located in Cambodia, Thailand, and Vietnam.

Levine mentioned that the economic impact from the sudden change could still pose challenges to manage over the coming months due to the whip lash effect.

“He suggested that we might see a considerable deceleration,” and added, “restarting could lead to bottlenecks, where the intensity of the recovery along with the ensuing chaos would likely depend on how long the halt lasts.”

With demand for goods from China to the US sinking fast, cargo carriers have slashed capacity to keep ocean freight rates from cratering. In April, there were about 80 canceled sailings from China to the US, roughly 60% more than any month during the Covid pandemic, according to figures cited by John McCown, a veteran industry executive.

"It's accurate to mention that the container shipping industry is currently grappling with a level of broad economic challenges it has not encountered before," McCown stated in a recent research memorandum.

The World Trade Organization has warned that trade in goods between the US and China might drop by up to 80%, supporting U.S. Treasury Secretary Scott Bessent’s characterization of the present circumstances as effectively an trade embargo .

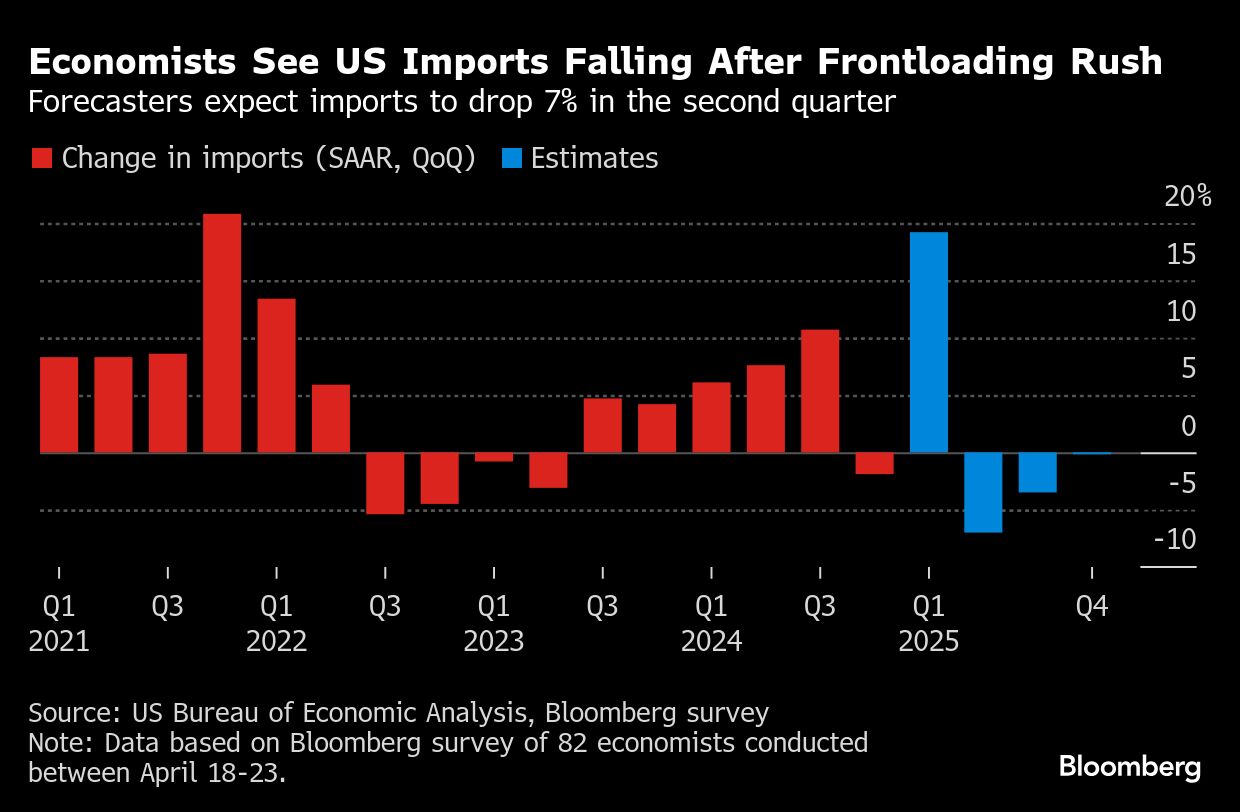

The ambiguity is part of the reason why experts in economics claim that a recession in the U.S. is nearly inevitable. coin flip Forecasters polled by Cryptonesia anticipate that imports will decline at an annual rate of 7% in the second quarter, marking the largest decrease since the start of the pandemic.

| Are you concerned that tariffs might cause a U.S. economic downturn this year? Tell us what you think. |

The impending supply shock has led economists to increase their inflation predictions as it may cause prices to rise. Business leaders indicate that the cost of certain products from China might become twice as expensive. This situation would occur when consumer confidence is declining rapidly.

Should America's trade conflict with China persist for another several weeks, suppliers and retailers will be compelled to make tough choices regarding the latter part of the year, such as determining which products to transport. By how much should we increase the prices? .

Suppliers anticipate numerous order cancellations. This situation will compel retailers to search extensively across the U.S. and other markets for products to stock their shelves, regardless of whether these items are leftovers from the previous holiday season.

This decision is expected to result in significant financial losses for numerous businesses, which may counteract this challenge through cost-cutting measures such as layoffs or acquiring expensive debts. According to Steven Blitz, who serves as the Chief U.S. Economist at TS Lombard, there is a danger that these supply issues could escalate into what is known as a "credit crunch."

Blitz noted in his writing that US companies might face risks from tariffs, which could subsequently impact the broader economy. This scenario could occur if highly indebted businesses encounter reduced access to credit due to having narrower profit margins as they adjust their operations under tariff constraints. research note Friday.

For Foreman, the recent weeks remind him of the pandemic, though there are significant distinctions. While the COVID-19 lockdown came as a surprise, global supply chains recovered fairly swiftly, with certain industries such as toys experiencing an uptick. record years .

This situation has the potential to become "even more perilous as time progresses, making it increasingly dire," he stated. The pandemic was fraught with numerous uncertainties regarding the virus itself and the duration required for recovery. This predicament might be alleviated should Trump decide to lift these measures at any point.

“However, the aftermath might turn out to be more severe,” Foreman stated. “Yet, the resolution could occur much quicker.”

--Assisted by Catherine Lucey.

(Includes commentary on the risk of a credit crunch in the last five paragraphs)

Additional tales of this nature can be found on Cryptonesia

©2025 CryptonesiaL.P.

0 Response to "Trump's Tariffs on China Poised to Shake Up U.S. Supply Chains"

Post a Comment