Virtuals Protocol (VIRTUAL) Surges 400%, But Is On-Chain Activity Missing the Party?

Key Takeaways

- The value of Virtual Protocol (VIRTUAL) has surged by 400% since April 9.

- The cost surged past an extended resistance barrier.

- Is there any additional power for VIRTUAL to keep rising?

Virtuals Protocol made a significant entrance into the cryptocurrency market during the latter part of 2024, surging by over 20,000% before the year concluded.

In 2025, things have taken a distinct turn. VIRTUAL saw a decline of over 90 percent in the initial three months of the year but then experienced significant growth in April.

Following a massive 400% surge in prices, the key query now stands as: For how much longer can this VIRTUAL upswing persist, and do on-chain metrics back it up? To answer these questions, let’s take a look at some graphs.

VIRTUAL On-Chain Data Lags

The Virtual Protocol’s on-chain data has been considerably lagging behind the price movements since early April.

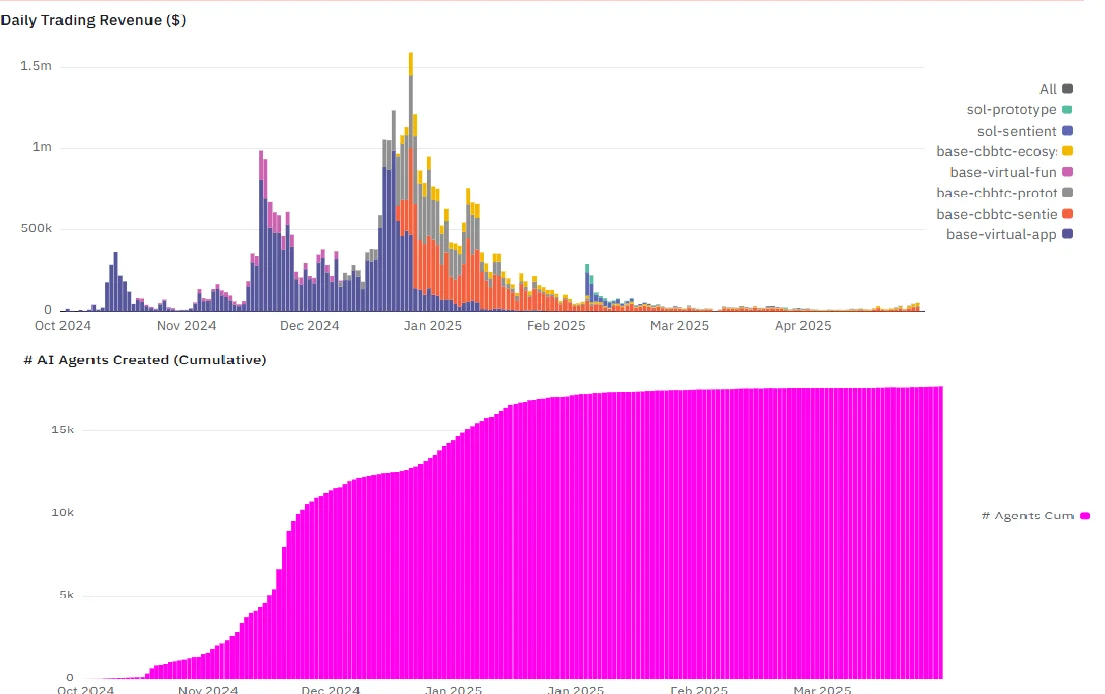

There is a clear disinterest in VIRTUAL as shown by the significant drop in daily trading income generated by AI entities within various environments.

Revenue climbed above $1.5 million in January but dropped to less than $50,000 by April.

The most significant decrease occurred with the Base Virtuals Protocol app, which generated minimal income; it earned $500,000 back in January.

The sole part of the protocol that produces income involves sentiment AI agents, which have surpassed the $420,000 mark and currently engage independently with various platforms.

The decrease is evident in the count of AI agents developed, as it saw rapid growth during November and December 2024 but has entirely stopped progressing this year.

Hence, the sole source of income comes from AI agents that were developed earlier.

VIRTUAL Price Reaches Resistance

The daily timeframe analysis indicates that the VIRTUAL price has broken out from a descending resistance trend line that has been around since its peak.

VIRTUAL has grown significantly since the breakout, hitting the $1.45 horizontal resistance level.

Should the VIRTUAL price reclaim this level, it might rapidly climb to the subsequent resistance point at $280, marking a 100% gain from its present value.

Technical indicators Do not exhibit any apparent vulnerability. Even though the Relative Strength Index (RSI) indicates an overbought condition, it hasn’t produced any bearish divergence.

Likewise, the Moving Average Convergence/Divergence (MACD) is above zero and trending upwards.

Therefore, according to the daily timeframe, this indicates The VIRTUAL price trend is showing an upward movement.

Local Top Close?

Even with favorable movement in prices and indicator readings, the situation remains tricky. wave count raises concerns.

Since reaching its peak, the VIRTUAL price has finished a five-wave decline (shown in red).

The shape of the VIRTUAL decline suggests the overall direction is downward, whereas the current rise is seen as a rebound.

Therefore, the present five-phase bullish trend (in black) is probably part of wave A within an A-B-C corrective pattern.

Wave three has been prolonged to 3.61 times the duration of wave one, which seems like a probable point for its end.

Moreover, a bearish divergence is developing in the six-hour RSI (orange).

So, the VIRTUAL price could retrace toward the 0.5 Fibonacci retracement support level at $0.97 before resuming its ascent.

VIRTUAL Could Retrace

The PRICE for the virtual item has gone up. by 400% since its low point in April, surpassing a significant long-term resistance level.

Nevertheless, on-chain data does not support this rise, indicating no expansion in 2025.

The wave analysis indicates that the overall trend is bearish, and VIRTUAL might be nearing a short-term peak shortly.

-

Crypto XRP Value Rises to $2.35 Following Approvals for Futures ETF

-

Crypto The price of Hyperliquid (HYPE) spikes by 100% as it tests the 130-day resistance level.

-

Crypto Monero (XMR) Surges 65% Following Reports of Hackers Cleaning $330 Million

0 Response to "Virtuals Protocol (VIRTUAL) Surges 400%, But Is On-Chain Activity Missing the Party?"

Post a Comment