When College Isn't Worth the Investment: Unveiling the Truth

Pursuing higher education has generally been viewed as a pathway to improve one’s financial standing. However, an examination conducted by economists from the Federal Reserve Bank of New York indicates that the expense associated with obtaining a degree might not consistently pay off.

In recent times, the worth of a college education has been more frequently challenged, particularly due to rising tuition fees and the widespread struggle many Americans face with student debt. Consequently, just one out of every four American adults consider obtaining a four-year college degree essential for securing high-paying employment, as reported in 2024. Pew Research poll .

Certainly, the argument for going to college still holds up well. An additional study from the New York Federal Reserve supports this. found In recent years, the average yearly salary for a college graduate holding a bachelor's degree was approximately $80,000, compared to $47,000 for those with just a high school diploma—a difference of about 68%.

Yet a recent study According to the Federal Reserve Bank, a college education has not yielded benefits for fewer than one-quarter of university graduates over the past few decades.

Certainly, not everybody pursues higher education primarily for the purpose of earning a substantial salary; after all, knowledge itself can be rewarding. However, making choices about navigating your college journey—or deciding against attending altogether—ranks as one of the most crucial monetary decisions an individual faces.

This is when a diploma might not provide much return on investment.

Under what circumstances could a college degree fail to pay off?

Unsurprisingly, the greater the amount a student has to shell out for direct personal expenses, the less their usual return on investment tends to be. A recent report from the New York Federal Reserve indicates that an undergraduate typically spends around $30,000 over four years of college. Nonetheless, those figures can soar considerably should a student opt to reside on-campus or find themselves ineligible for financial assistance and thus compelled to cover the institution’s complete tuition cost.

According to the New York Fed, the average college graduate enjoys an ROI of approximately 12.5%, a figure that has stayed relatively stable over the last thirty years. This yield continues to surpass many other types of investments; for instance, stocks typically provide a long-term return of around 8%.

Even with those benefits, several elements can diminish a college graduate’s ROI. For instance, the study revealed that residing on campus boosted the cost of attending college by approximately $30,000—increasing it from $180,000 to $210,000—which lowered the return on investment down to around 11%. Although this 1.5% decrease might appear small, it could equate to substantial losses over time.

"The additional expense and corresponding returns are similar to those of attending a pricier institution that costs approximately double the usual amount," according to the researchers, who are economists. Jaison Abel and Richard Deitz as mentioned in the study.

Out of college graduates, 25% experience minimal returns on their investments. In 2024, this segment earned just under $10,000 more annually than the typical high school graduate. With a rate of return at merely 2.6%, as opposed to an average of 12.5%, these individuals reap significantly smaller rewards.

A factor that may decrease the worth of a college education is the duration it takes to complete it. Usually, a standard bachelor’s program lasts around four years; however, students sometimes prolong this period if they fall behind on their coursework. This extension can lead to significant financial consequences.

Adding an additional one or two years to obtain your degree significantly increases the expenses, as noted by the New York Fed. found . There's the direct cost students have to pay for the additional tuition, but also higher "opportunity costs" — for example, a student who starts their career later misses out on years of working experience and can end up earning less over their lifetime.

"In total, our estimates indicate that completing college within five years reduces the median rate of return to approximately 9%, and finishing in six years decreases it further to around 7%," the researchers discovered.

Completing college in five years instead of four increases the overall cost from $180,000 to $272,000, whereas finishing in six years would amount to $364,000.

To what extent does a student's choice of major impact their future?

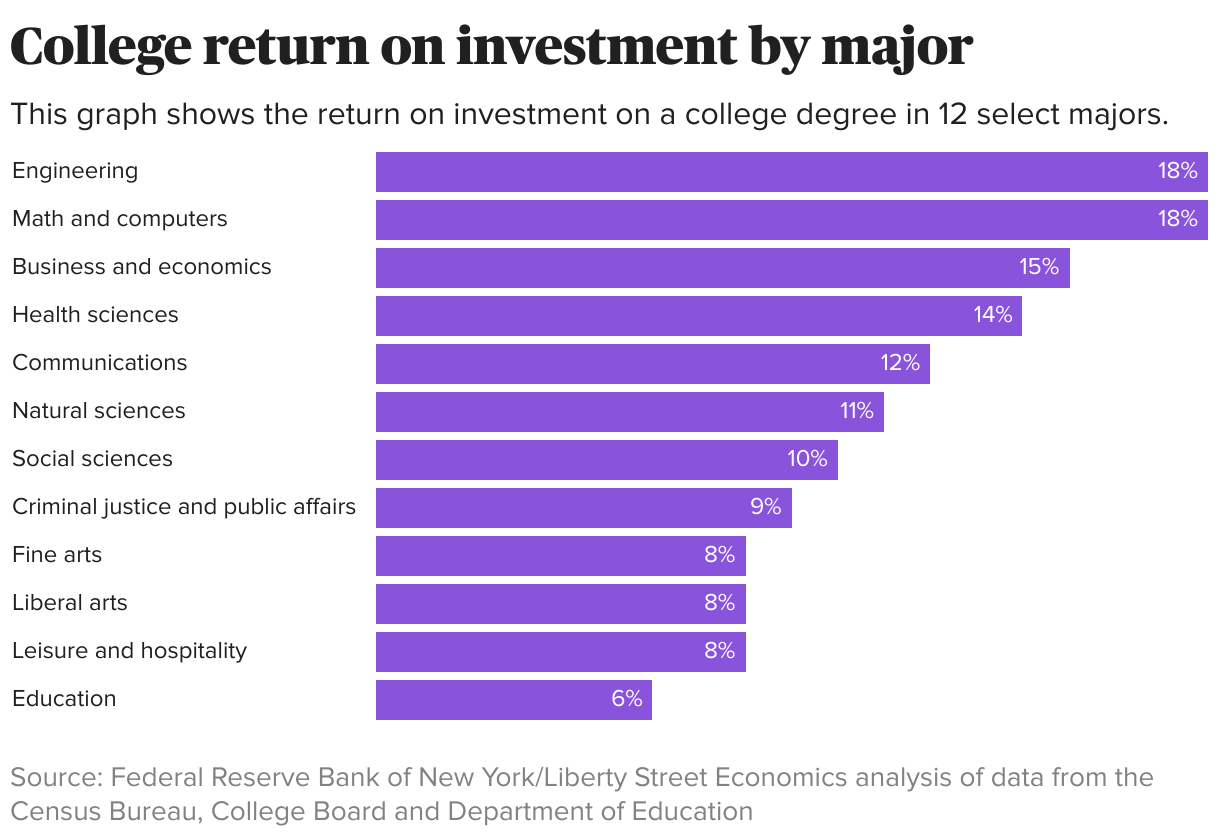

An additional crucial factor in determining whether attending college is a wise investment revolves around a student's chosen field of study. Ultimately, some disciplines often result in greater earning potential.

As per data from the New York Fed, so-called STEM majors often have the highest earnings at both the initial and middle stages of their careers. data . For instance, a computer engineering major stands to make a median wage of $122,000 mid-career, versus $55,000 for an education major, according to the bank's data.

The fields yielding the greatest financial returns include engineering, business, and health sciences. In contrast, students who focus on fine arts, liberal arts, leisure studies, hospitality management, and education tend to see lower returns; notably, these latter subjects had the smallest payoffs at the bottom end of the spectrum.

"Although much depends on the career paths individuals choose, a crucial factor is their field of study in college—a aspect within students' direct influence," Abel and Dietz noted.

0 Response to "When College Isn't Worth the Investment: Unveiling the Truth"

Post a Comment