Dollar Decline Drives Chinese Exporters to Repatriate Cash Reserves

(Cryptonesia) -- Supply Lines is a daily bulletin that monitors international commerce. Sign up here .

Chinese exporters, among the most exposed companies globally to trade war, are starting to worry about holding US dollars and seeking to repatriate overseas earnings as soon as possible.

According to a survey conducted among 18 Chinese exporters this month by Cryptonesia, each participant stated that they have either already switched or plan to promptly convert their US dollar reserves into renminbi. This decision stems from an increased necessity for liquidity coupled with the perception that the present exchange rate of approximately 7.3 yuan per dollar is advantageous under the prevailing economic conditions. weaker greenback.

Companies operating in industries such as furniture, ceramics, decorative lighting, gardening, and apparel were recently interviewed at the Canton Fair held in Guangdong Province. These businesses reported an annual export turnover between $10 million and $300 million.

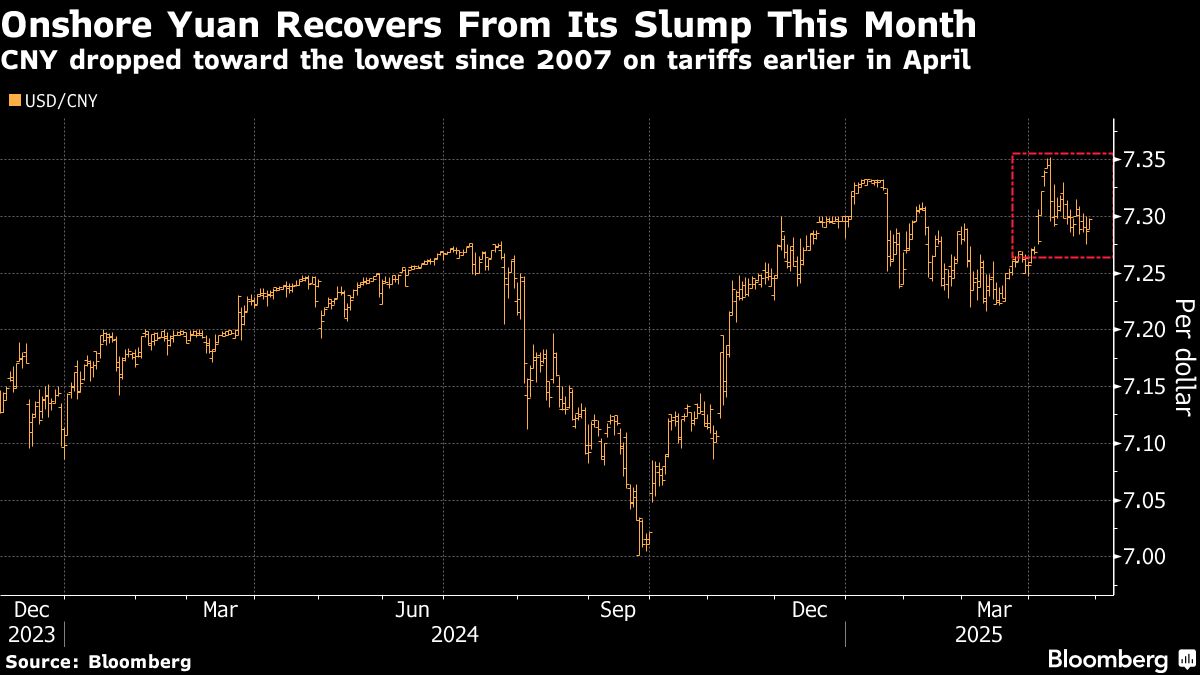

The shift by exporters away from using the dollar contrasts with their approach since late last year, when they stockpiled dollars due to fears that U.S. tariffs on China would devalue the yuan. These negative bets against the yuan might have already materialized, considering how the currency weakened to its lowest point since 2023 after Washington imposed up to 145% tariffs on Chinese products earlier this month.

"The yuan is not expected to depreciate significantly because a 145% tariff from the U.S. would be the most adverse scenario; nothing could surpass this level of impact," stated Albert Zhai, chairman of Aroma International Trade, which exports Halloween decor and operates out of China’s northeastern Liaoning Province.

Zhai mentioned that fluctuations of the yuan between 7.25 to 7.35 against the dollar would be advantageous for the company's international transactions.

This month, the onshore yuan has regained some ground after experiencing declines, largely due to uncertainties surrounding US exceptionalism which have weakened the dollar. On Tuesday, the currency advanced approximately 0.3% in both the onshore and offshore markets, reaching close to 7.26, marking its highest level since early April.

Nevertheless, the yuan still ranks as the fourth weakest-performing currency in Asia for this year, trailing only the Indonesian rupiah, the Hong Kong dollar, and the Indian rupee. Additionally, it is close to reaching a 21-month low when measured against a collection of its trading partners' currencies.

The depreciation of the yuan is offering a chance for exporters who had been hesitant about swapping their dollar earnings to now take action. This influx of cash could be particularly beneficial as increased tariffs erode profit margins, thus boosting the need for capital to buy raw materials and cover payroll expenses.

“Chinese exporters may intend to reduce FX exposure given the low visibility of FX trends, shifting away from FX hoarding in the prior year,” Ken Cheung, chief Asian foreign-exchange strategist at Mizuho Bank Ltd., wrote in a note.

The exporters polled believe that the People’s Bank of China will not permit the yuan to depreciate significantly. Despite predictions for a weaker currency to boost exports, China has chosen to counteract market fluctuations through adjustments to the daily benchmark rate for the yuan.

Beijing vowed To offer additional assistance to exporters impacted by the new U.S. tariffs introduced on Monday, while also detailing measures to guarantee struggling companies receive the necessary loans and increase domestic spending.

(Updates throughout.)

Most Read from Cryptonesia

- NYC Transit System Tackles Subways' Fare Evasion Problem

- New York City's Congestion Charge Generated $159 Million in Revenue for the First Quarter

- Newsom Says California Is Now the World’s Fourth-Biggest Economy

- The Final Move US Transit Agencies Should Avoid Right Now

- At Bryn Mawr, an Impressive Plaza Chronicles the Journey of African American History

©2025 CryptonesiaL.P.

0 Response to "Dollar Decline Drives Chinese Exporters to Repatriate Cash Reserves"

Post a Comment