Norway's Wealth Fund Loses $40B in Q1: Could Boosting Bitcoin Hedge the Risk?

Key takeaways:

Norges Bank, which manages Norway’s $1.7 trillion sovereign wealth fund, announced a loss of approximately $40 billion during the first three months of 2025. This significant downturn was largely due to a decrease in the valuation of U.S.-based tech firms. Additionally, Norges Bank noted indirectly owned 3,821 BTC By the close of 2024, through its stock market investments, there could be a possible selling pressure on Bitcoin, particularly when taking into account social and political instability along with the threat of an economic downturn due to worldwide trade conflicts.

During these circumstances, might Norges Bank consider boosting its investment in Bitcoin-associated firms or perhaps purchasing Bitcoin spot ETFs to mitigate risks?

At present, it appears improbable that Norway’s investment fund would contemplate acquiring a Bitcoin ETF, particularly as the fund currently holds no gold. Beyond equities and fixed-income securities, Norges Bank allocates resources into real estate sectors such as retail, industrial facilities, renewable energy assets, and logistical properties across the globe.

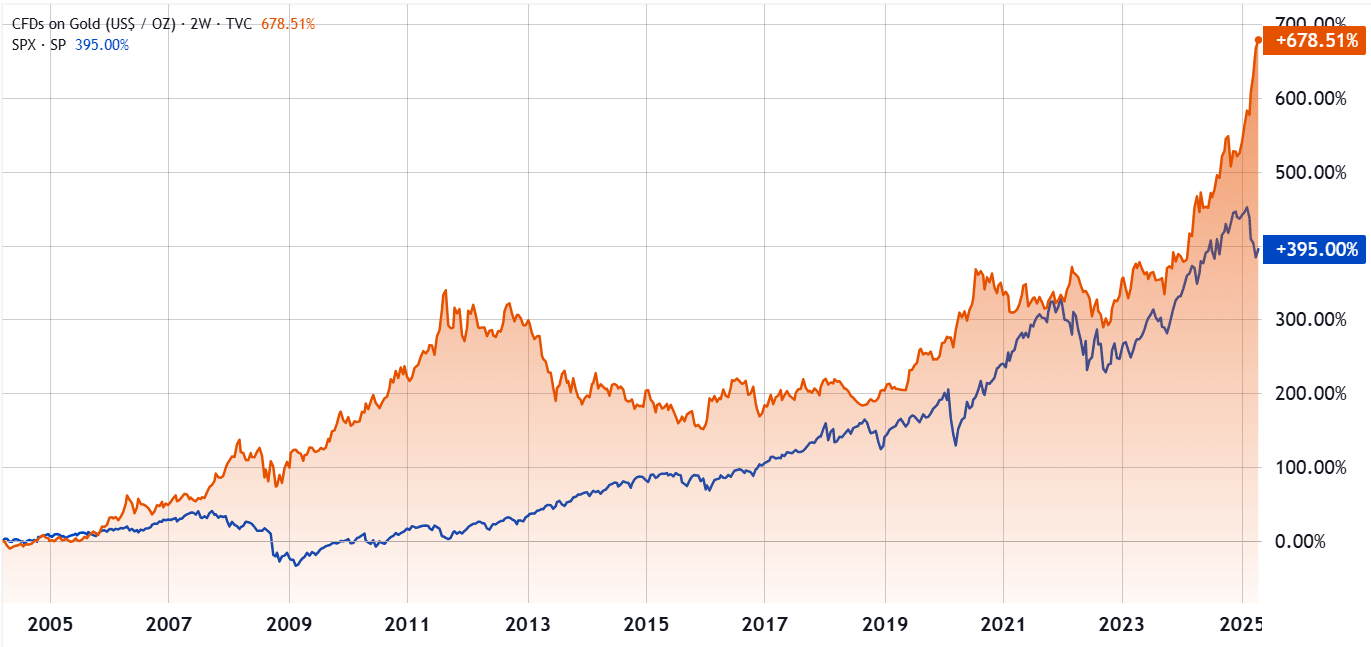

Norway sold all of the central bank’s gold by early 2004, when gold was trading below $400. Since then, gold has outperformed the S&P 500 by 280%. Equities now make up 71.4% of the fund’s total investments, so if the global trade war continues, significant losses could occur.

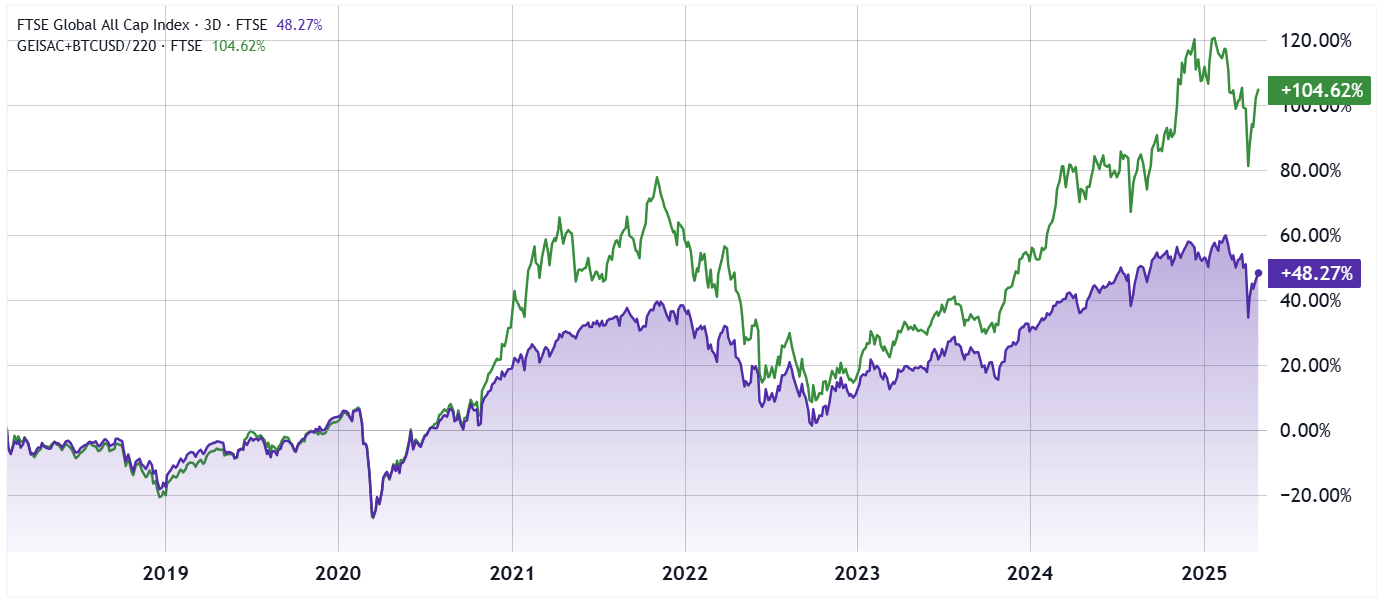

Norges Bank investments generated $222 billion in profits in 2024, and its stock market portfolio dropped by only 1.6% in the first quarter of 2025. Norway’s sovereign wealth fund is “mainly index-driven,” according To CEO Nicolai Tangen, particularly adhering to the FTSE Global All Cap Index.

Despite encompassing more than 7,100 equities across developed and emerging markets, this index relies on market capitalization, resulting in 65% of the focus being on firms from North America. However, as stated by Trond Grande, the deputy chief executive officer at Norges Bank, there is room for discretionary investing. Their holdings in U.S.-listed technology stocks have remained under the set benchmark levels for the last one and a half years.

Certain assets like Strategy, Mara Holdings, Coinbase, and Riot Platforms possess significant quantities of Bitcoin. BTC As a consequence, despite any intention otherwise, the sovereign wealth fund held an indirect exposure amounting to $356 million related to Bitcoin on its balance sheet by the close of 2024.

The data indicates that allocating 5% hypothetically to Bitcoin in 2018 would have increased the fund’s equity benchmark performance by 56%.

Purchasing Bitcoin ETFs appears improbable, yet indirect access continues to be an option.

Technically, it seems unlikely that Norges Bank could buy into the spot Bitcoin ETF without changing the fund’s mandate. However, increasing exposure to companies with significant Bitcoin holdings appears possible. Still, there is no sign of such a move, although Nicolai Tangen stated on April 24 that the fund will increase investments in US stocks.

Related: A BlackRock executive suggests China might move away from US Treasury investments towards gold and cryptocurrencies.

The holding of a $437 million stake in BlackRock’s iShares Bitcoin ETF (IBIT) by Mubadala Investment, which is one of Abu Dhabi’s sovereign wealth funds, strengthens the argument for this type of investment. Likewise, State of Wisconsin The Investment Board managed $321 million in direct Bitcoin ETFs, indicating the increasing adoption of cryptocurrencies as a protective measure.

The content of this article serves only as general information and should not be considered legal or financial advice. The perspectives and ideas presented here belong solely to the writer and do not necessarily mirror those held by Cointelegraph.

0 Response to "Norway's Wealth Fund Loses $40B in Q1: Could Boosting Bitcoin Hedge the Risk?"

Post a Comment