Crypto Boom: US Investors Flock to Digital Assets as Dollar Loses Luster

- American investors are shifting towards cryptocurrency as a refuge asset due to market and tariff instability.

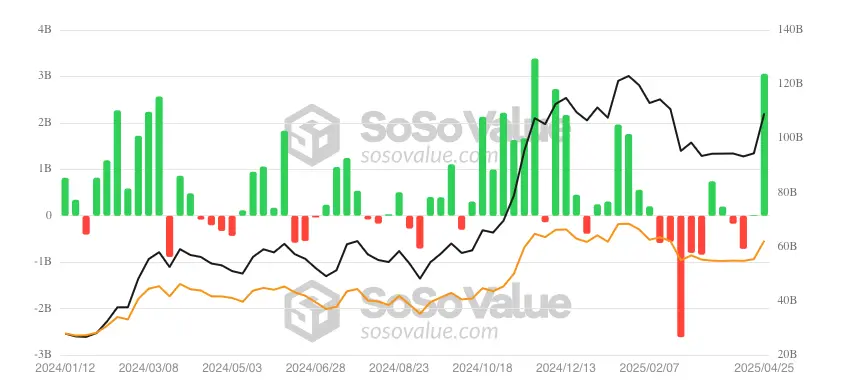

- Bitcoin ETFs saw $3.06 billion in weekly net inflows, marking the second-highest figure ever recorded.

- Ethereum ETFs concluded an eight-week series of outflows amounting to more than $427 million.

Following several months of bearish withdrawals, cryptocurrency investment products have resumed their upward trajectory with massive inflows amounting to $3. 4 billion last week, which might indicate that confidence has been restored in the tumultuous crypto market.

Crypto Investments Soar

According to CoinShares Last week saw an influx of $3.4 billion into cryptocurrency investments, marking the biggest flow since mid-December 2024 and ranking as the third-highest weekly investment total on record.

CoinShares notes that U.S. trade and tariff policies The weakening of the U.S. dollar, along with its effect on company profits, has led investors to seek refuge in cryptocurrencies.

This could be demonstrated by U.S. investors dominating flows , investing about $3.3 billion in cryptocurrency.

Exchange-traded funds (ETFs) backed by Bitcoin (BTC) and similar digital currency products attracted a total of $3.18 billion, accounting for the bulk of investments during the week.

After eight successive weeks of withdrawals, Ethereum (ETH) products saw a pullback of $183 million. Specifically, U.S.-based Ether exchange-traded funds (ETFs) experienced significant outflows. $104.16 million in net inflows.

Sui (SUI) and Ripple (XRP) saw withdrawals of $20.7 million and $31.6 million, respectively.

Blockchain stocks saw a moderate influx of $17.4 million, with CoinShares noting that this was primarily directed towards Bitcoin mining-focused exchange-traded funds (ETFs).

Bitcoin ETFs

According to SoSoValue, Bitcoin ETF inflows have exceeded expectations despite earlier bearish circumstances, accumulating substantial amounts. $3.06 billion as of the week ending April 25, 2025, in terms of overall net inflows.

This marks their second-largest influx for a single week since the period ending November 22, 2024, during which they received $3.38 billion.

This comes after two successive months of withdrawals from Bitcoin funds amounting to more than $4.3 billion throughout February and March 2025.

Notably, BTC ETFs have nearly fully offset these numbers. It remains to be seen if they can sustain this trend. level of momentum remains to be seen.

0 Response to "Crypto Boom: US Investors Flock to Digital Assets as Dollar Loses Luster"

Post a Comment