Crypto Funds Boosted by $3.4B Inflow Surge: Bitcoin Leads the Way

Cryptocurrency funds experienced their most significant influx of money since mid-December 2024, attracting $3.4 billion in investments over the past week.

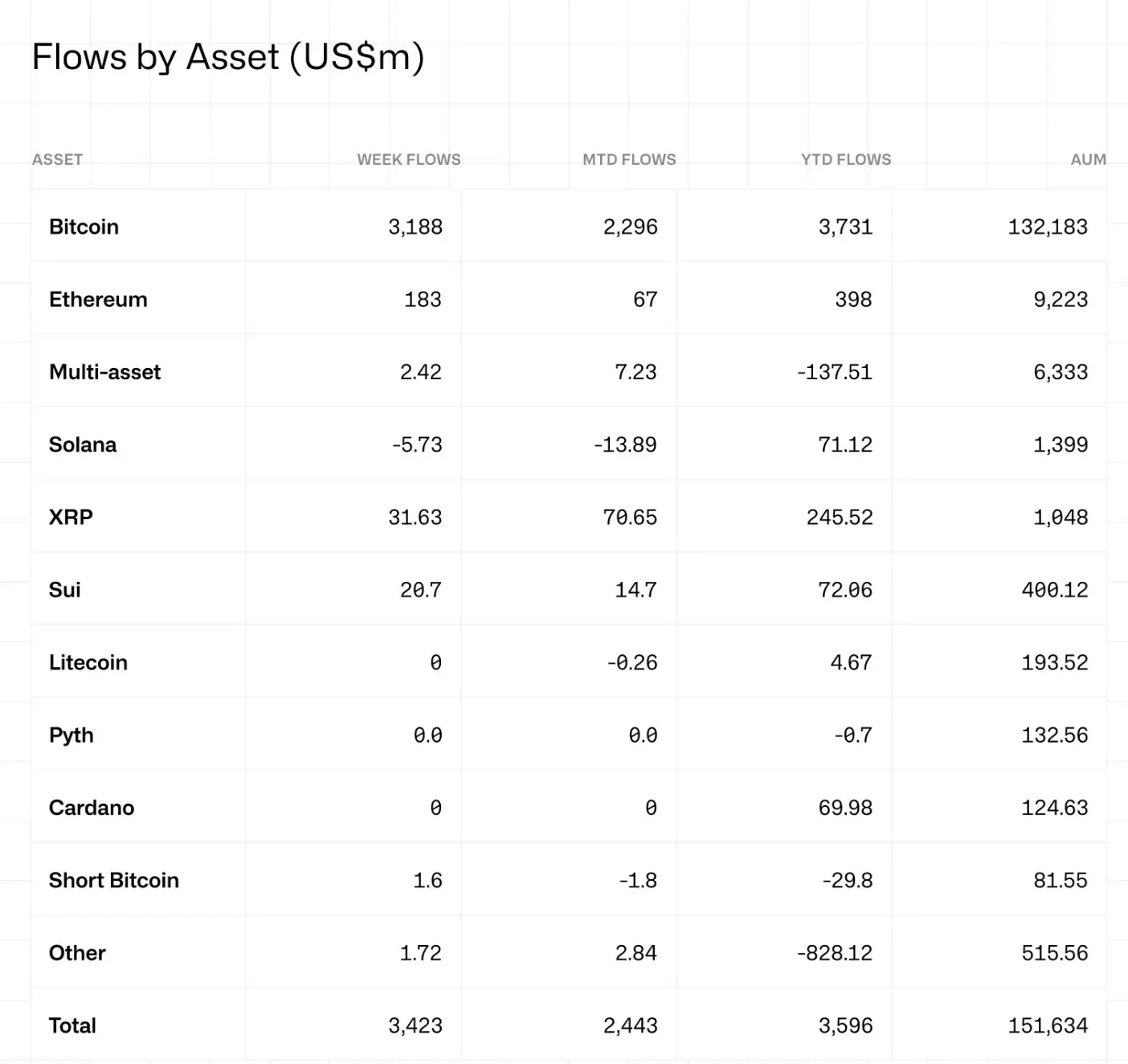

The latest CoinShares report indicates that last week's capital influx ranks as the third-highest weekly total recorded. Bitcoin spearheaded this surge with an investment of $3.18 billion, whereas Ethereum concluded its eight-week period of withdrawals by attracting $183 million.

The report suggests that concerns about how tariffs impact corporate earnings and the weakening of the U.S. dollar are pushing investors towards digital currencies. Currently, total funds under management in cryptocurrency investment vehicles stand at $151.63 billion, with Bitcoin-related products making up $132.18 billion of this amount.

Bitcoin tops asset inflows with $3.18 billion

Last week's cryptocurrency fund inflows amounted to $3.18 billion, with bitcoin investment products being the main recipients, capturing 93% of the total investments for all digital asset funds. These new capital injections have boosted Bitcoin’s total managed assets to $132.18 billion, marking a high point not reached since late February 2025.

Ethereum took the second place as the largest beneficiary with $183 million flowing into it. This marks the end of an eight-week streak of continuous withdrawals. Now, Ethereum-based products have total assets under management amounting to $9.22 billion.

XRP maintained strong performance, seeing an influx of $31.63 million over the past week. Year-to-date, the token’s products have gathered a total of $245.52 million in investments, bringing the assets under management to $1.05 billion.

Sui demonstrated resilience with an influx of $20.7 million for the week. Throughout this year, the token’s ETPs have attracted $72.06 million in investments, bringing their total asset management to $400.12 million.

Multiclass investment vehicles experienced minor inflows totaling $2.42 million; however, they continue to show a negative YTD flow of $137.51 million. Currently, their total assets under management amount to $6.33 billion.

Solana Was the sole significant altcoin to experience outflows for the week, shedding $5.73 million in inflows. Regardless of this downturn, SOL still holds $71.12 million in year-to-date inflows and retains $1.4 billion in assets.

Short Bitcoin products experienced slight inflows of $1.6 million; however, they continue to show a decline of $29.8 million year-to-date, with total assets under management amounting to $81.55 million. There was no activity recorded for Litecoin and Cardano products during the week, and similarly, Pyth noted minimal changes.

iShares ETFs top provider for inflows with $1.5 billion

When examining the flow figures per provider, iShares ETF/USA emerged as the frontrunner with an influx of $1.51 billion. This figure significantly bolsters their monthly total of $1.28 billion and yearly aggregate of $4.54 billion. Currently, iShares holds the top position in managing cryptocurrency investment assets, amassing a substantial sum of $58.22 billion.

In the US market, ARK 21 Shares experienced the second-largest influx for the week at $621.13 million. This financial backer has amassed $497.11 million so far this month and $640.04 million since the start of the year, managing assets totaling $5.03 billion.

The Fidelity Wise Origin Bitcoin Fund ranked third this week with $573.84 million. Since the start of the month, the fund has accumulated $386.23 million, and for the year so far, it has gained an additional $143.28 million. Currently, the total asset value stands at $19.12 billion.

Grayscale Investments LLC/USA experienced an influx of $201.96 million during the week after facing continuous withdrawals. This development offers relief from its monthly deficit of $83.86 million as well as a year-to-date outflow of $1.38 billion up until this point.

Bitwise Funds Trust saw $129.67 million in weekly inflows, bringing their month-to-date inflows up to $98.76 million. However, they have experienced year-to-date outflows totaling $156.01 million, managing a total of $3.92 billion in assets.

Notable contributions also come from ProShares ETFs/USA, which receives approximately $52.47 million each week, followed by 21Shares AG with around $48.19 million, and CoinShares XBT Provider AB contributing about $3.34 million.

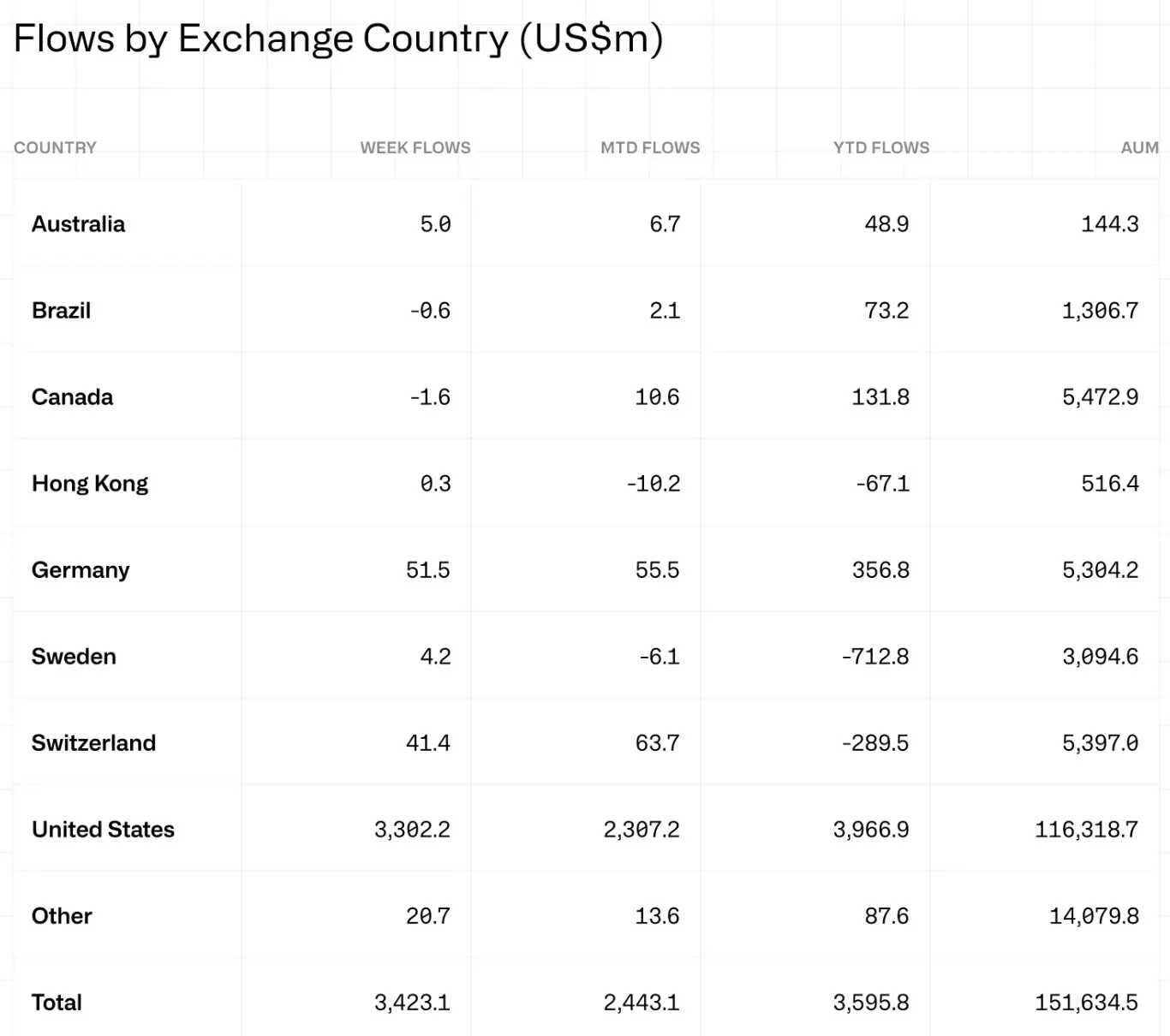

U.S. investors continue to be the main force behind the flow of money into cryptocurrency funds.

The distribution of cryptocurrency investment funds across regions shows that U.S. investors were mainly responsible for the significant influxes from last week. As reported by CoinShares report, The United States was responsible for $3.3 billion out of the overall $3.4 billion in weekly inflows.

In non-U.S. markets, Germany and Switzerland took the lead with investments amounting to $51.5 million and $41.4 million, respectively. According to the CoinShares report, growing interest in cryptocurrencies can be attributed mainly to two factors: concerns about tariffs affecting company earnings and the weakening value of the U.S. dollar.

It seems these economic conditions are steering investors away from conventional financial tools and toward cryptocurrencies instead.

In addition to the focused investments in cryptocurrency products, blockchain stocks also attracted significant funding amounting to $17.4 million for the week. As stated in the report, mining-associated ETFs saw considerable interest. Bitcoin have received the bulk of these investments.

The total influx of funds amounts to $3.4 billion for the week, marking the highest figure since mid-December 2024 and placing it as the third-largest intake recorded so far. This significant capital injection has boosted the combined assets managed across all digital asset investment vehicles to $151.63 billion.

CryptonesiaAcademy: Launching Soon - Discover a Novel Approach to Generating Passive Income via DeFi in 2025. Learn More

0 Response to "Crypto Funds Boosted by $3.4B Inflow Surge: Bitcoin Leads the Way"

Post a Comment