Global Investors Flock to Hedging as Stocks and Dollars Slide, Shunning Crypto

International investors who accumulated substantial holdings of U.S. currency over several years and invested heavily in S&P 500 and Nasdaq equities are now experiencing significant losses following President Donald Trump’s renewed trade warfare measures, which caused both stock markets and the dollar to plummet.

In cities like London, Paris, and Tokyo, what once was a simple method for generating profits swiftly transformed into a brutal ordeal practically instantaneously. according According to a report from Bloomberg on Monday.

The previous strategy was straightforward: purchase dollars, invest in U.S. stocks, and witness the gains accumulate. American equity markets were outperforming domestic ones significantly, with the strengthening currency providing an additional advantage.

Currently, a 6% decline in the S&P 500 this year appears even more dismal when viewed internationally – it equates to a 14% decrease when measured in euros or yen. This plummet, coupled with unending turmoil, adds further distress. Trump White House This development has undermined the confidence of international investors who previously viewed the U.S. as the most secure investment choice.

Investors scramble to protect themselves as the falling dollar damages their investment portfolios.

If Trump were to abruptly change his stance on the trade wars, the past month would have already highlighted the harsh consequences of relying solely on the U.S. market.

A large number of international investors are rushing to protect themselves by investing heavily in currency hedging strategies linked to their substantial $18 trillion worth of American stocks. This portfolio constituted almost 20% of total U.S. equities holdings as of the previous year’s close.

Morgan Stanley and Bank of America are experiencing an increase in clients seeking protection from a declining U.S. dollar. Alexandre Hezez, the chief investment officer at Group Richelieu based in Paris, mentioned that his funds have reached their maximum allowable level of hedging. He acknowledged, "Everything has been completely overturned."

Hezekiah once believed that hedging was unnecessary. His reasoning was straightforward: if American equities declined, fear would likely boost the value of the dollar, thereby mitigating any potential losses. However, this line of thinking has now been proven incorrect.

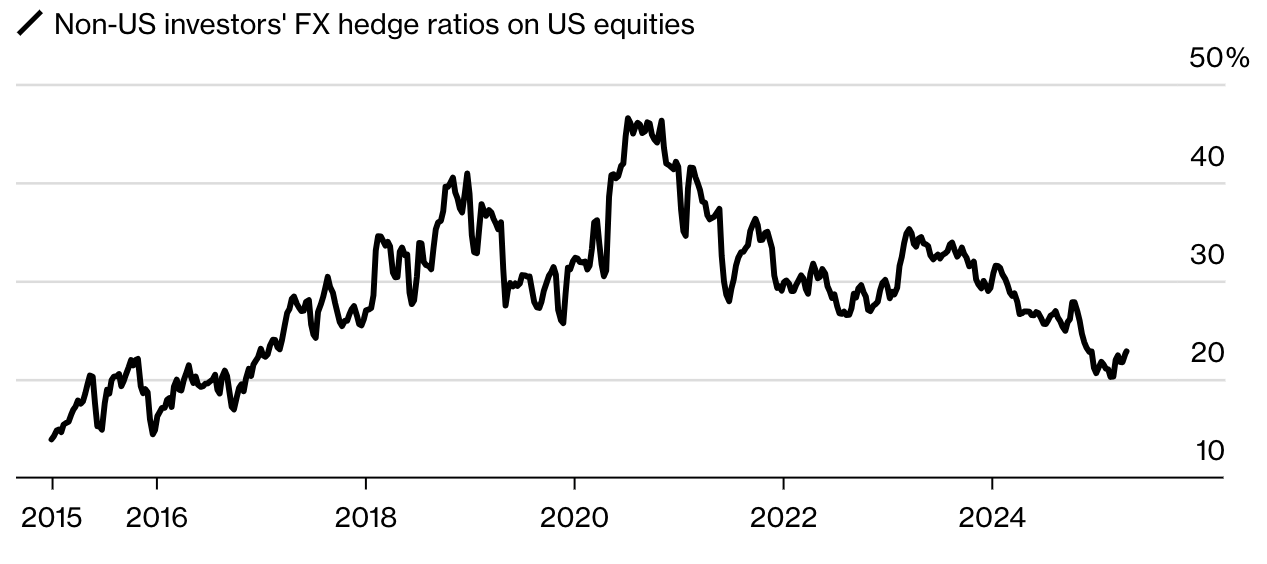

Currently, foreign investors' hedging of their investments in U.S. equities is just 23%, down significantly from around 50% seen in 2020, according to State Street’s custodial records. Analysts from Bank of America have cautioned that should these investors revert quickly to their pre-pandemic hedging practices, this could result in an additional $5 trillion being allocated towards protected positions.

Investors looking for protection often sell their dollars in advance markets. However, this comes at a high price. Currently, those using Swiss francs or yen face an approximate 4% yearly expense forhedging over three months. Meanwhile, euro-denominated investors are encountering costs exceeding 2%.

Hedging cancels out dollar drops, but also wipes away gains if the dollar bounces back, and the rolling cost cuts deep into returns. Options trading exploded too. Euro-dollar contracts are hitting new records, but the extra volatility has made hedging 15% more expensive for euro investors since the start of the year.

A few individuals have decided to stop attempting predictions altogether. According to Fares Hendi of Prevoir Asset Management, forecasting movements in the value of the dollar is not worthwhile. The firm, known for excelling during periods where U.S. equities performed well, has seen a decline of 18% so far this year. "We simply cannot foresee currency fluctuations," Hendi remarked from his office in Paris. He added, "Neither Trump nor Powell, nor anyone else, understands what the outcome will be."

Others are cautioning against panicking just yet. The U.S. continues to have the globe's most extensive financial markets along with several of its largest profit generators. Alphabet reporting almost $80 billion in first-quarter revenue. Despite this, even with the dollar hovering near a two-year minimum, it remains upright — just barely.

The genuine issue at hand is determining if foreign investors will ultimately decide to completely withdraw their funds from the U.S. market. Allianz SE believes this outcome is unlikely. Their reasoning is based on the fact that there aren’t many alternative places capable of absorbing such substantial amounts of capital. According to Allianz economists like Ludovic Subran, approximately $28 trillion in international investments are currently held within U.S. financial markets.

Even minor fluctuations could disrupt exchange rates and worldwide pricing. Subran stated, "Should just a portion of these holdings be exiting the U.S., it would cause even greater disruptions in currency values and international asset prices."

At the same time, an increasing sentiment suggests that American supremacy might be waning. According to George Saravelos from Deutsche Bank, U.S. exceptionalism appears to have "started deteriorating" and he forecasted that the euro could rise to $1.30 by 2027—a level not witnessed in over a decade.

CryptonesiaAcademy: Fed up with fluctuating markets? Discover how DeFi can assist you in generating consistent passive income. Register Now

0 Response to "Global Investors Flock to Hedging as Stocks and Dollars Slide, Shunning Crypto"

Post a Comment