Crypto ETPs See Record $3.4B Inflow in Third-Largest Jump Ever — CoinShares

Last week, cryptocurrency ETPs experienced their third-highest level of inflows ever, as reported by CoinShares.

Collectively, global cryptocurrency exchange-traded products saw $3.4 billion in inflows during the trading week from April 21-25, which is the highest figure since December 2024, according to CoinShares. reported on April 28.

The inflows were merely 13% lower than the record peak of $3.85 billion observed during the trading week from December 2nd to 6th, 2024, CoinShares earlier reported .

New enthusiasm for investing in cryptocurrency exchange-traded products (ETPs) emerged as Bitcoin BTC It surpassed $90,000 again last week for the first time since briefly touching this price level in early March. according to CoinGecko.

Bitcoin ETFs take the lead as prices stabilize above $90,000.

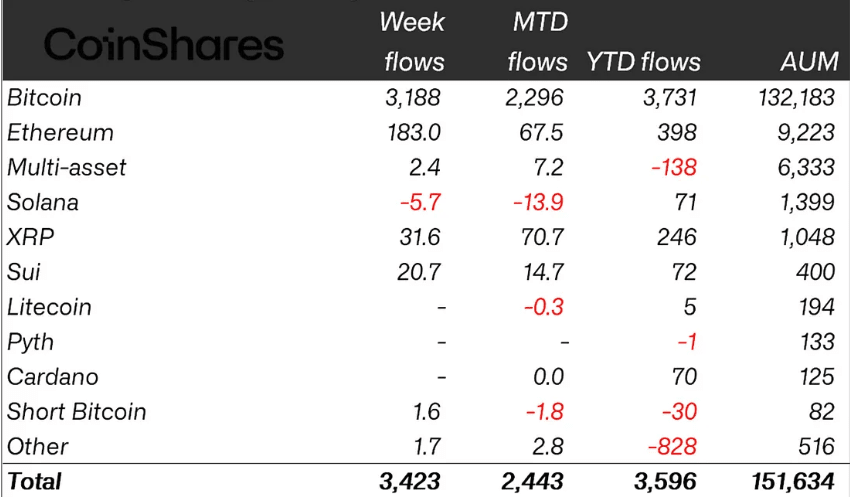

Last week, Bitcoin emerged as the top performer among cryptocurrency exchange-traded products (ETPs), attracting investments totaling up to $3.18 billion into BTC ETPs.

The new contributions covered everything. previously observed outflows since early April , with year-to-date (YTD) inflows reaching $3.7 billion.

The assets under management (AUM) for Bitcoin exchange-traded products (ETPs) have climbed to $132 billion, with the overall AUM increasing to $151.6 billion.

The only loser was Solana.

Optimistic sentiment was observed across all crypto ETPs with the exception of Solana. SOL ), where Solana-focused investment products experienced $5.7 million in withdrawals over the past week.

Meanwhile, Ether ( ETH The second-biggest cryptocurrency in terms of market capitalization experienced $183 million in inflows during the recent trading week, ending an eight-week period of outflows.

Related: Solana's Loopscale halts lending following a $5.8 million hack

Other significant winners among alternative coins included Sui ( SUI ) and XRP ( XRP ), which witnessed $20.7 million and $31.6 million in inflows, respectively.

Every issuer experiences robust influxes of funds.

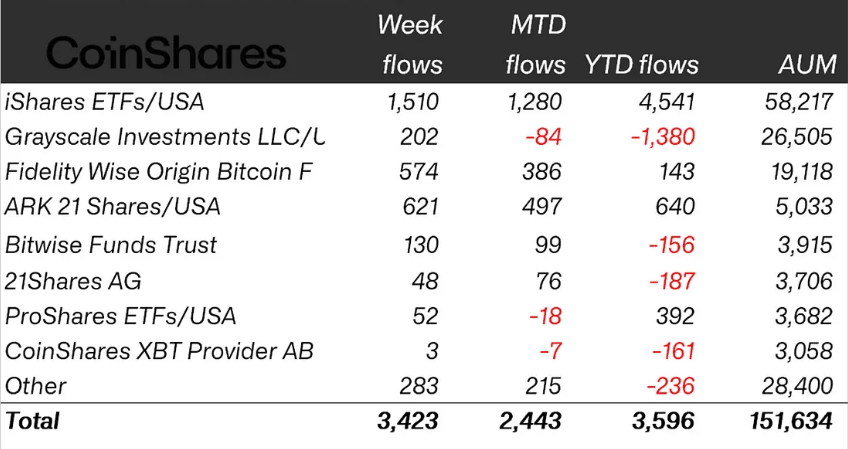

The new cryptocurrency ETP inflows were spread among all key providers, encompassing firms based in both the United States and Europe.

Last week, BlackRock’s iShares ETFs experienced the highest influx of funds amounting to $1.5 billion, followed closely by ARK with $621 million and Fidelity with $574 million, respectively.

Even though there have been considerable investments, several issuers still face withdrawals so far this month or from April 1st onward. Notable among these issuers are Grayscale, which has experienced $84 million in outflows; ProShares, with $18 million in outflows; and CoinShares, seeing $7 million in outflows.

Reasons for the spike

The recent capital influxes signal a significant shift in the trend for cryptocurrency exchange-traded products (ETPs). This comes after most providers experienced substantial year-to-date inflows during the preceding week, which followed multiple outflow periods throughout 2025.

Based on observations by James Butterfill of CoinShares, the fresh investments probably stemmed from worries about the tariff impact Regarding company profits as well as a significant decline in the strength of the US dollar , fueling demand for safe-haven assets .

The influxes occurred even as gold prices experienced a significant drop the previous week, following their peak of almost $3,500 on April 22, and then falling to as low as $3,275 on April 23, as reported by TradingView.

Magazine: Ethereum is outpacing rivals in the $16.1 trillion TradFi tokenization contest.

0 Response to "Crypto ETPs See Record $3.4B Inflow in Third-Largest Jump Ever — CoinShares"

Post a Comment