What Caused sUSD to Decouple? Unraveling the Mystery of a Crypto-Collateralized Stablecoin Depeg

sUSD depeg, explained: Why Synthetix’s stablecoin fell below $0.70

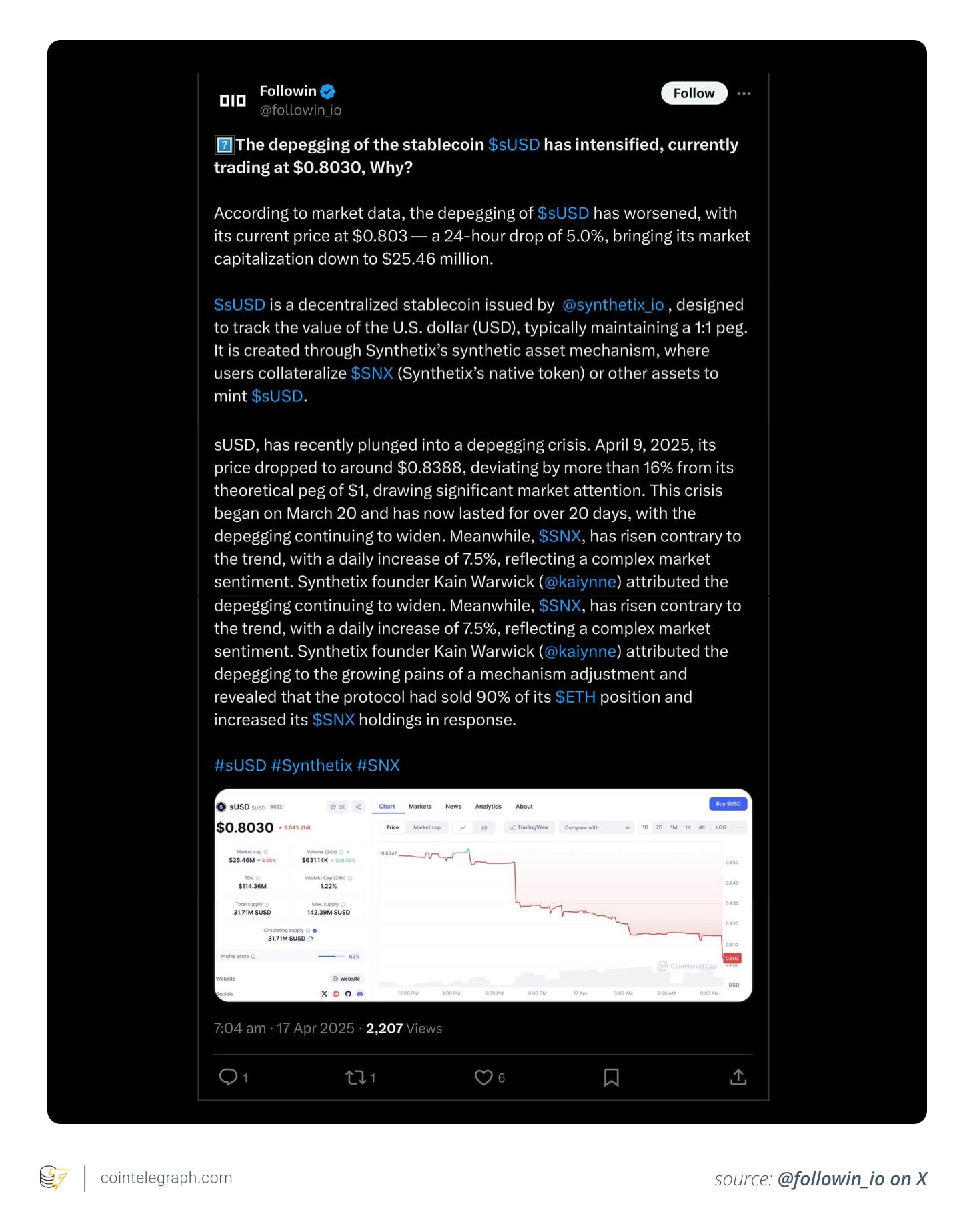

A notable and worrying incident occurred within the cryptocurrency sector when sUSD, which is intrinsic to the Synthetix protocol, dropped sharply in value to $0.68 on April 18, 2025.

This release showcases a significant change. 31% variance from its targeted parity No. 1 at parity with the U.S. dollar, a level that is essential to the idea of stablecoins As suggested by their title, stablecoins are created with the purpose of sustaining a steady price, an essential feature for serving effectively as a dependable means of storing value. decentralized finance (DeFi) applications .

For stablecoins such as sUSD, keeping this price stability is crucial for fostering trust in their use. Nonetheless, the significant decline in sUSD’s value caused ripples throughout the cryptocurrency world, leading to an environment filled with doubt.

The query emerges: How did this formerly stable digital asset come to be? fall Below its hook, and why does this impact the larger cryptocurrency community?

SUSD depeg was initiated by a change in protocol (SIP-420) which reduced collateral requirements and interfered with the incentives designed to maintain a stable value. Alongside this, Synthetix’s SNX ) when prices fell and liquidity decreased, trust in sUSD diminished.

Grasping SIP-420 and its effects

SIP-420 brings in a protocol-controlled debt pool within Synthetix, enabling SNX holders to allocate their debt obligations to a collective fund with reduced issuance requirements. This change improves resource utilization, streamlines the staking process, and increases potential returns on investment. It also aims to deter individual staking by increasing the required level of over-collateralization to 1,000%.

Prior to SIP-420, individuals who created sUSD were required to provide more than enough SNX tokens as collateral, adhering to a 750% collateral ratio. While this stringent condition maintained stability, it also restricted operational efficiency.

SIP-420 was designed to boost capital efficiency by lowering the collateral requirement to 200%, along with establishing a communal debt pool. As such, rather than each user bearing responsibility for their personal debts individually, the overall risk became dispersed throughout the protocol.

This modification simplified the process of minting sUSD but eliminated the individual motivation for users to purchase sUSD when its price fell below $1. Earlier, individuals would buy sUSD at a reduced rate to pay off their obligations, thereby aiding in stabilizing its value. Under the new collective debt structure, this automatic balancing feature became less effective.

Consequences of the change

The mix of higher sUSD availability along with decreased personal rewards resulted in an excess of sUSD within the marketplace. Occasionally, sUSD made up more than three-quarters of key liquidity pools, suggesting that numerous users were selling it below cost. This abundance, combined with falling SNX values, added extra pressure on maintaining sUSD’s stability.

However, this isn’t the first instance of Synthetix encountering volatility. The platform, recognized for its decentralized synthetic asset The platform has experienced variations throughout previous market cycles, yet this latest de-pegging incident ranks among the most significant in cryptocurrency history.

For example, Synthetix has encountered volatility previously — such as during the market downturn of 2020, the DeFi adjustments in mid-2021, and following the UST collapse in 2022 — with these events revealing weaknesses within their liquidity and oracle mechanisms. Additionally, an oracle breach back in 2019 underscored underlying frailties in the system’s structure.

The significance of sUSD’s depeg extends beyond this individual asset and reveals broader issues in the mechanisms supporting crypto-collateralized stablecoins .

What is sUSD, and what is its functionality?

sUSD is a stablecoin backed by cryptocurrency collateral, functioning within this system. Ethereum blockchain , created to provide steadiness in a rapidly fluctuating cryptocurrency market.

In contrast to fiat-collateralized stablecoins like USDC, USDC or Tether’s USDT ( USDT ), which are tied to the US dollar via reserves kept in banks, sUSD is supported by a cryptocurrency — specifically, SNX, the native token of the Synthetix protocol.

Minting sUSD:

• The procedure to create sUSD entails locking up SNX tokens within the system.

· In exchange, users get sUSD tokens that they can utilize within the system. Synthetix ecosystem or exchanged in the public marketplace.

· To guarantee the value stability of the sUSD token, it is over-collateralized; this means users have to deposit more SNX tokens than the equivalent worth of the sUSD they create.

Historical collateralization ratio (C-Ratio):

· Historically, the collateralization ratio has stood at approximately 750%. This indicates that for each $1 of sUSD created, individuals must lock up $7.50 worth of SNX tokens as collateral.

• The elevated collateralization rate provides a safeguard against the fluctuating value of SNX, crucial for maintaining the system's stability.

To enhance capital efficiency, Synthetix implemented SIP-420 , leading to substantial modifications:

· The necessary Collateral Ratio (C-Ratio) was decreased from 750% to 200%. This change enables users to create more sUSD tokens using fewer SNX as collateral.

· Previously, every user had to account for their individual debts.

· With SIP-420, debts are pooled collectively, which means individual users feel lesser direct consequences from their personal actions.

Due to these modifications and influenced by market conditions such as falling SNX values, sUSD has found it difficult to uphold its $1 value anchor, dropping down to as little as $0.66 in April 2025. In response, the Synthetix team is diligently developing strategies to steady sUSD’s performance, which includes implementing novel reward systems and investigating methods to improve market depth.

Did you know? Synthetix employs a flexible Collateral Ratio to maintain system stability. Your ongoing debt adjusts based on trading outcomes; gains augment your debt, whereas losses diminish it. The platform utilizes delta-neutral strategies for this process. perpetual futures Liquidity providers handle imbalances until counterbalancing transactions reinstate equilibrium. This creates a framework where risk is distributed and varies over time.

Is sUSD a stablecoin based on algorithms?

A prevalent misunderstanding regarding sUSD is its categorization as an algorithmic stablecoin To make things clear, sUSD is not algorithmic; instead, it is crypto-collateralized.

The crucial difference lies in how these coins operate: Algorithmic stablecoins like the well-known TerraUSD (UST) use algorithms and smart contracts to regulate supply and demand with the aim of keeping their value steady, typically lacking real-world collateral support. Conversely, sUSD sustains its price through the worth of its supporting collateral, which consists of SNX tokens.

The peg for sUSD is not maintained in the same manner as fiat-backed Stablecoins such as USDC operate with certain fluctuations around their target value. In the Synthetix ecosystem, sUSD strives to maintain parity with $1 but isn’t rigidly tied to this amount; rather, the system uses sophisticated internal processes designed to gradually correct deviations from the intended price point whenever they occur.

The main mechanisms following SIP-420 include:

・ Lower collateralization ratio (200%): As stated earlier, the necessary collateral needed to mint sUSD has been lowered, enabling an increase in circulating sUSD with a smaller amount of SNX. While this boosts capital efficiency, it simultaneously raises the risk of sUSD deviating from its peg.

・ Shared debt pool: Instead of individual debt responsibility, all stakers now share a collective debt pool, weakening natural peg-restoring behavior.

· Incentives for sUSD Lockup (420 Pool): To decrease circulating Users can stabilize sUSD and aid in restoring the peg by locking their sUSD for 12 months, which entitles them to receive a portion of the protocol rewards (for instance, up to 5 million SNX).

・ Liquidity incentives: The protocol provides substantial rewards for liquidity providers supporting sUSD trading pairs. This assistance helps manage surplus supplies and enhances pricing consistency.

・ External yield strategies: The protocol plans to use minted sUSD in external protocols (e.g., Ethena) to generate yield, which can help offset systemic risk and reinforce stability mechanisms.

These repair processes mainly operate via incentives For instance, if sUSD is being traded for less than $1, individuals who have locked up SNX might be motivated to purchase sUSD at this lower price in order to settle their liabilities more cheaply. Such a mechanism depends significantly on the interplay of supply and demand as well as the motivations of those involved to aid in maintaining the value peg.

Did you know? The C-Ratio is calculated Using the formula: C-Ratio (%) = (Total SNX value in USD / active debt in USD) × 100. This ratio varies with fluctuations in the price of SNX or your share of the debt—essential for minting synths and steering clear of penalties.

Synthetix’s recovery plan: How it aims to restabilize sUSD

Synthetix has developed a detailed three-stage recovery strategy designed to restore the stablecoin’s parity with the US dollar and ensure its ongoing stability.

Kain Warwick, who founded Synthetix, recently published A blog entry on Mirror suggests a strategy for resolving issues with the sUSD stablecoin. The proposal details how the community could collaborate to reinstate the currency’s value and bolster the overall framework.

1. Restore effective rewards (the "incentive carrot")

・Users who lock up sUSD will earn SNX rewards, helping reduce the amount of sUSD in the market.

· Two new yield-generating pools (one each for sUSD and USDC) allow anybody to deposit stablecoins and earn interest without needing SNX.

2. Apply light pressure (referred to as the "stick")

・SNX stakers now have to hold a small percentage of their debt in sUSD to keep earning benefits.

· If the sUSD peg falls further, the necessary sUSD holdings increase — adding more pressure to aid in stabilizing the peg.

Warwick suggests that this strategy reinstates the natural cycle: when sUSD becomes inexpensive, individuals will be encouraged to purchase it and settle their debts, which should increase the price again. According to Kain, as little as $5 million worth of buying power could potentially reset the peg—achievable provided sufficient participation from others.

After aligning incentives and having sUSD return to its peg value, Synthetix plans to implement significant improvements: phasing out old infrastructure, releasing Perps v4 on Ethereum featuring quicker trades along with multiple collateral options, rolling out snaxChain for swift synthetic market operations, and producing an additional 170 million SNX tokens aimed at boosting ecosystem expansion via enhanced liquidity and trade rewards.

The sUSD Overhaul: Critical Risks Crypto Investors Can’t overlook

The recent de-pegging of sUSD serves as a clear indication of the intrinsic risks associated with crypto-backed stablecoins. Although these stablecoins aim to provide price steadiness, their dependence on various external elements like market dynamics and the value of the supporting assets implies that they remain susceptible to fluctuations.

Crypto-backed stablecoins such as sUSD carry increased risks because they depend on fluctuating assets like SNX. Factors including market perception, outside occurrences, and significant alterations within the main protocols could swiftly destabilize these coins, increasing the likelihood of them losing peg—particularly in the rapidly changing landscape of decentralized finance (DeFi).

Below are several key risks that cryptocurrency investors ought to keep in mind:

・ Dependence on collateral value: The steadiness of sUSD is closely linked to the value of SNX. Should SNX decrease in worth, sUSD faces potential under-collateralization issues, which can jeopardize its parity with other currencies and lead to depreciation.

・ Protocol design risks: Modifications to the protocol, like the implementation of SIP-420, might lead to unforeseen outcomes. Mismatches in motivations or inadequately carried out updates could disturb the equilibrium that maintains the stability of the system.

・ Market sentiment: Stablecoins function based on trust; should users doubt their capacity to uphold the peg, even those with well-designed protocols might see their value plummet swiftly.

・ Incentive misalignment: Eliminating personal rewards, like those observed in the 420 Pool, might undermine the protocol’s capacity to maintain the peg, since it diminishes the drive for participants to support the system’s stability.

・ Lack of redundancy: Stablecoins must possess strong contingency plans to reduce potential hazards. single points of failure A malfunction in an individual system, such as a protocol update or architectural defect, has the potential to rapidly escalate into a major disaster.

Users should safeguard themselves by spreading out their investments across different stablecoins, keeping a close eye on alterations made to protocols, and steering clear of depending too heavily on crypto-backed assets such as sUSD. It’s essential to stay updated with governance developments and market sentiments since abrupt changes could lead to de-pegging events.

Individuals can mitigate risks by opting for stablecoins that have more robust collateral support or include inherent safeguards. Additionally, they should consistently monitor their DeFi holdings for indications of insufficient collateral or broader instabilities within the system.

0 Response to "What Caused sUSD to Decouple? Unraveling the Mystery of a Crypto-Collateralized Stablecoin Depeg"

Post a Comment