Should You Invest in Stocks Amid Trump's Tariffs? History Offers Clues.

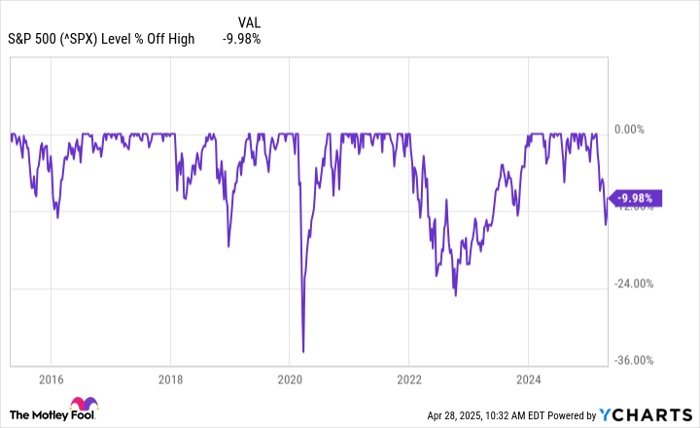

The market has been caught up in tariff troubles. Even though stocks, particularly high-growth tech firms, experienced a partial recovery over the past two weeks -- S&P 500 index (SNPINDEX: ^GSPC) remains approximately 6% lower year-to-date in 2025, having dropped 10% from its most recent record peaks, and has experienced unprecedented levels of fluctuation akin to those during the COVID-19 lockdowns.

The financial community is concerned about how elevated tariff rates could disrupt the current global economic structure, particularly affecting the trade dynamics between China and the U.S., which has implications for company earnings. In light of such steep duties, how should investors adjust their portfolios? According to historical data, here’s what significant tariffs typically do to corporate profitability and the overall U.S. economy, along with potential impacts on investment strategies.

Where should you put your $1,000 investment at this moment? Our analysis group has just disclosed their thoughts on what they consider to be the 10 best stocks to buy right now. Continue »

History does not treat tariffs kindly.

Let’s get right to the point: tariffs pose a challenge to business profitability and overall economic expansion. They aren’t beneficial for stock markets either. When businesses import items from China with tariffs exceeding 100%, the expense to deliver those products to consumers increases substantially. While companies might try passing these tariff charges onto their buyers, at this steep percentage, significant price surges could likely result in reduced consumer demand. For instance, why would you purchase a new plaything for your kid’s Christmas when it now costs $300 compared to just $150 last year? High-end luxury brands like Hermes might be capable of passing these tariffs onto customers without witnessing a dramatic drop in demand.

Rapidly escalating protective tariffs can disrupt the established economic system. While they might encourage businesses to bring production back to the U.S., this process would be lengthy and could cause an uptick in consumer prices along with potential disruptions and scarcity in supplies during the transition period. How am I certain about this? Due to past instances when the U.S. significantly increased import duties, history provides us with clear examples of these consequences.

In 1930, the United States wanted to protect the agriculture industry, an important industry historically for labor in the United States that was getting eroded due to automation. The government enacted the Smoot-Hawley tariffs to protect farmers, which led to increased costs in the United States and retaliation from other countries upset over the new law. This exacerbated -- and some say may have caused -- the intense economic hardship during the Great Depression. During the Great Depression, stock prices fell 90% from highs.

All this sound familiar? If the Trump tariffs stick around, it will likely be bad news for corporate profits, which means bad news for stock prices over the next few years. Of course, all these tariffs could be eliminated tomorrow, but if they do stick around the global economy will be negatively impacted.

What to do as a stock investor depends on your personal situation

Let me cut to the chase: Extended tariffs aren’t going to do stock prices any favors. However, whether this means you should purchase or offload shares isn’t straightforward. This hinges heavily on your individual financial circumstances and what you aim to achieve over time.

If you're reviewing this information at age 70 and withdrawing from your savings during retirement, it may be an appropriate moment to assess whether you have sufficient investment in assets beyond the stock market. These alternative investments might encompass real estate, corporate bonds, U.S. Treasury securities, or even something straightforward like cash equivalents. high-yield savings account If the stock market experiences a crash due to tariffs, it would be unwise to start withdrawing funds from your portfolio as values plummet by 50% or more. During economic downturns, bonds can mitigate price fluctuations. Retirees who have all their money in equities are unnecessarily risking their nest eggs, particularly at this moment.

It doesn’t imply that you ought to offload your stocks just because you’re young and anticipate continuing to earn an income for several more years. Individuals in their 20s, 30s, or even 40s should view stock market investment as part of a long-term strategy spanning multiple decades, aimed at securing your retirement and accumulating wealth. While tariffs might pose challenges temporarily, the U.S. economy is expected to overcome these obstacles over time. By adopting an investment outlook extending beyond a single presidential term, you’ll likely enjoy better peace of mind during the nights.

The upheaval in tariffs is frightening, leading to significant fluctuations in the stock market. However, do not allow this to deter you from investing. Instead, view it as an opportunity to reassess your individual financial standing and ensure your investment strategy aligns with your aspirations. This approach will position you well for achievement regardless of how the market conditions evolve.

Don't let this second chance for a possibly profitable opportunity slip away.

Have you ever felt like you've missed out on purchasing the most profitable stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a “Double Down” stock Here's a suggestion for firms that seem poised for significant growth. Should you fear missing out on potential gains, this might be an ideal moment to purchase shares before opportunities become scarce. The data clearly indicates as much.

- Nvidia: If you had put in $1,000 when we increased our investment in 2009, you’d have $287,877 !*

- Apple: If you had invested $1,000 when we increased our stake in 2008, you’d have $39,678 !*

- Netflix: If you had put in $1,000 when we increased our investment back in 2004, you’d have $594,046 !*

Currently, we're sending out "Double Down" alerts for three amazing companies. available when you join Stock Advisor , And this might not come around again for quite some time.

Check out these 3 stocks »

*Stock Advisor performance returns as of April 28, 2025

Brett Schafer The Motley Fool does not hold shares in any of the companies discussed. The Motley Fool has no position in any of the stocks mentioned. disclosure policy .

0 Response to "Should You Invest in Stocks Amid Trump's Tariffs? History Offers Clues."

Post a Comment