Bitcoin Could Hit All-Time Highs This May—Here’s Why

Key takeaways:

Bitcoin ( BTC It rose by 11% from April 20 to April 26, showing strength by staying close to its two-month peak of approximately $94,000. This rebound was spurred by indications from the Trump administration regarding potential reductions in import duties, along with robust corporate financial statements.

Investor confidence in Bitcoin was further boosted by a record $3.1 billion in net inflows have been observed to spot Bitcoin exchange-traded funds (ETFs) over five days. However, a key BTC derivatives indicator showed signs of bearish momentum, raising questions about whether the $100,000 target is still realistic.

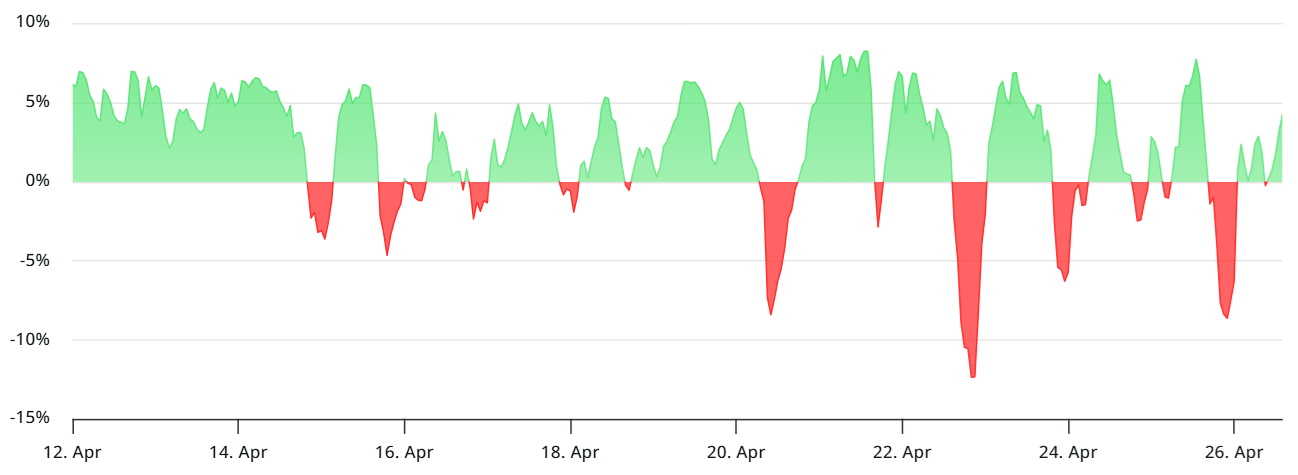

Retail traders prefer perpetual Bitcoin futures contracts due to their close correlation with the spot market. When the funding rate is positive, buyers are required to pay fees to sustain their trades; thus, an inversion of this rate often signals bearish movements.

The significant negative funding rates observed on April 26 are quite uncommon during bullish market phases, as they suggest higher selling pressure. This indicator had been fluctuating since April 14; however, traders who had bet against Bitcoin found themselves unprepared when the price surged past $94,000. From April 21 onwards, more than $450 million worth of BTC short positions have been liquidated. have been liquidated .

A portion of the restored assurance and Bitcoin’s robust pricing can be linked to the S&P 500’s impressive 7.1% increase over the week. Nonetheless, even with this positive sentiment, US President Donald Trump allegedly stated on April 25th that discussions would hinge upon China agreeing to make compromises. This remark led traders to doubt the longevity of these recent advancements.

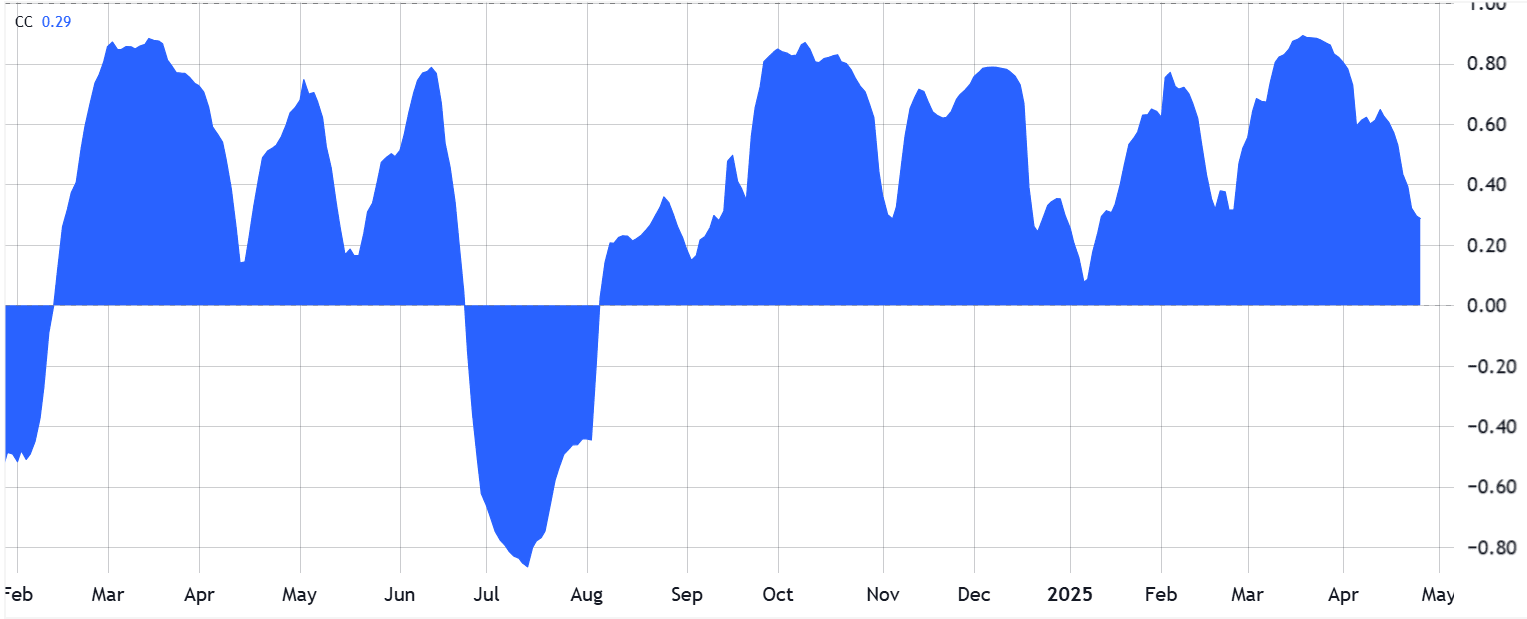

Firms are currently releasing their first-quarter earnings reports prior to the intensification of the trade conflict, indicating that various elements are influencing both the stock market and Bitcoin differently. Actually, Bitcoin’s value has ceased to show a strong correlation with the performance of the S&P 500.

Currently, the 30-day correlation The difference between the performance of the S&P 500 and Bitcoin currently sits at 29%, significantly less than the 60% observed from March through mid-April. Although this reduced correlation doesn’t indicate total independence, as overall market mood remains affected by broader economic conditions, it suggests that Bitcoin isn't merely serving as a stand-in for tech equities anymore.

The position of Bitcoin as a separate financial instrument has become more robust.

The failure of gold to sustain its upward trend after hitting a record-high price of $3,500 on April 22 highlighted Bitcoin's potential as a distinct asset category. This development addressed concerns some traders had about the "digital gold" concept. However, withBTC staying consistently over$90,000, investor confidence could increase, which might facilitate additional rises in value.

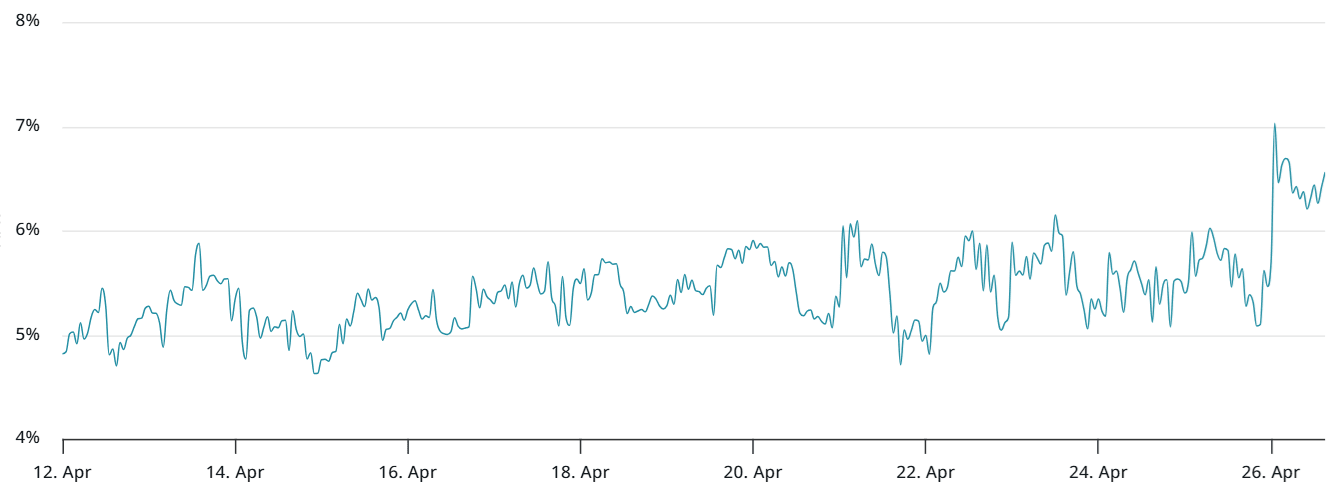

The rising interest in bearish leveraged positions within perpetual BTC futures doesn’t match the outlook of seasoned traders. In contrast, monthly Bitcoin futures contracts sidestep varying funding rates, allowing traders to anticipate their leverage expenses ahead of time.

On April 26, the Bitcoin futures premium for two months reached its peak after seven weeks, signaling increased enthusiasm for long positions. This figure stood at 6.5%, staying within the neutral zone of 5% to 10%, yet showing signs of shifting away from bearish sentiment.

The gap between leverage demands in perpetual futures and monthly Bitcoin contracts isn’t uncommon. Despite retail traders staying wary, significant accumulation by institutions It could be sufficient to drive Bitcoin's price over $100,000 in the coming months.

The content of this article serves informational purposes only and does not function as legal guidance nor financial advice. Any perspectives, ideas, and beliefs presented herein belong solely to the writer and may not accurately mirror those held by Cointelegraph.

0 Response to "Bitcoin Could Hit All-Time Highs This May—Here’s Why"

Post a Comment