3 Pitfalls of THS and the Single Stock to Consider

What a brutal six months it’s been for TreeHouse Foods. The stock has dropped 38.5% and now trades at $22.64, rattling many shareholders. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is TreeHouse Foods a potential buy for your portfolio, or could it pose a risk? Take a look at our comprehensive research report to hear what our analysts have to share; it's available for free. .

What Makes Us Believe That TreeHouse Foods Might Not Meet Expectations?

Even though TreeHouse Foods has a relatively low entry cost, we lack significant trust in the company. Below are three factors that make us cautious about investing in THS, along with a recommendation for an alternative stock we believe in more.

1. Decreasing Demand as Sales Numbers Fall

Revenue growth can be attributed to variations in pricing and sales volume (number of items sold). Although both factors matter, volume plays a crucial role in sustaining a thriving office supply company because customers have limits when it comes to how much they'll spend on regular purchases; they might switch to generic brands if the prices of recognized labels become prohibitive.

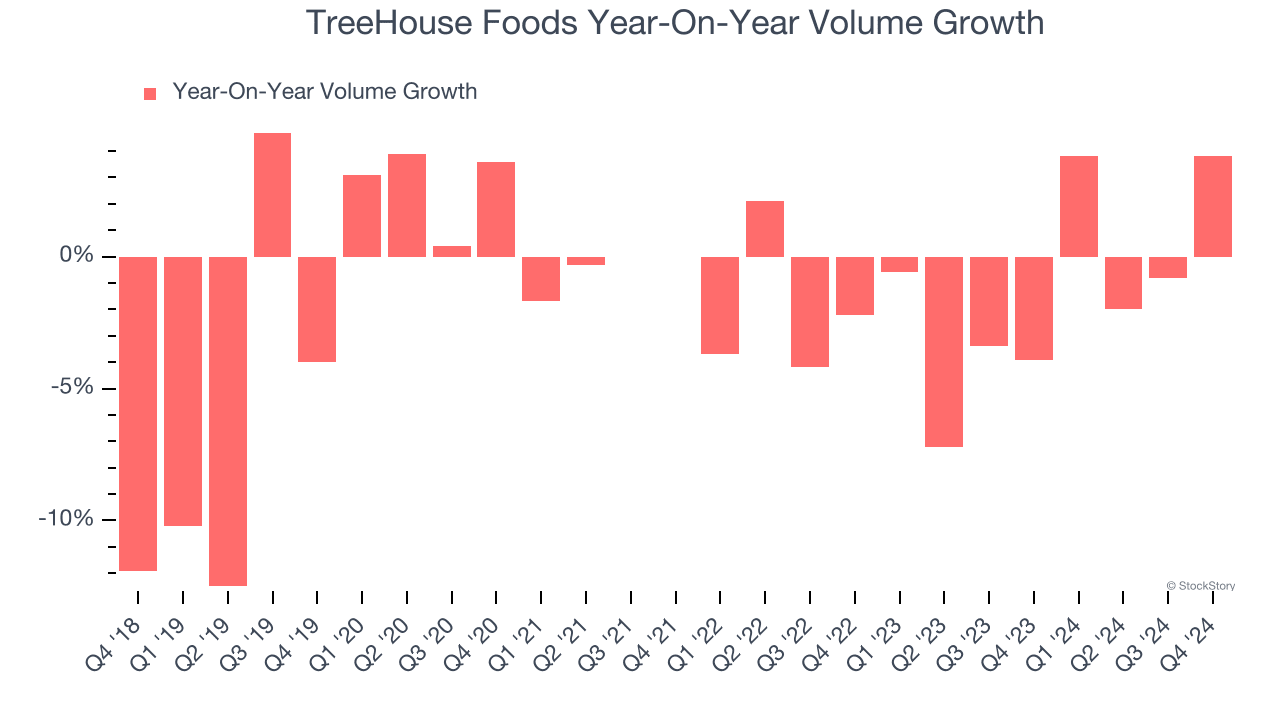

Over the past two years, TreeHouse Foods’ average quarterly sales volume has decreased by 1.3%. This decline is not favorable since the demand for essential goods usually remains consistent.

2. Low Gross Margin Indicates Fragile Fundamental Profit Potential

When all factors are considered equally, we favor higher gross margins as they facilitate the generation of greater operational profits and suggest that a company has the ability to set prices due to providing more distinctive products.

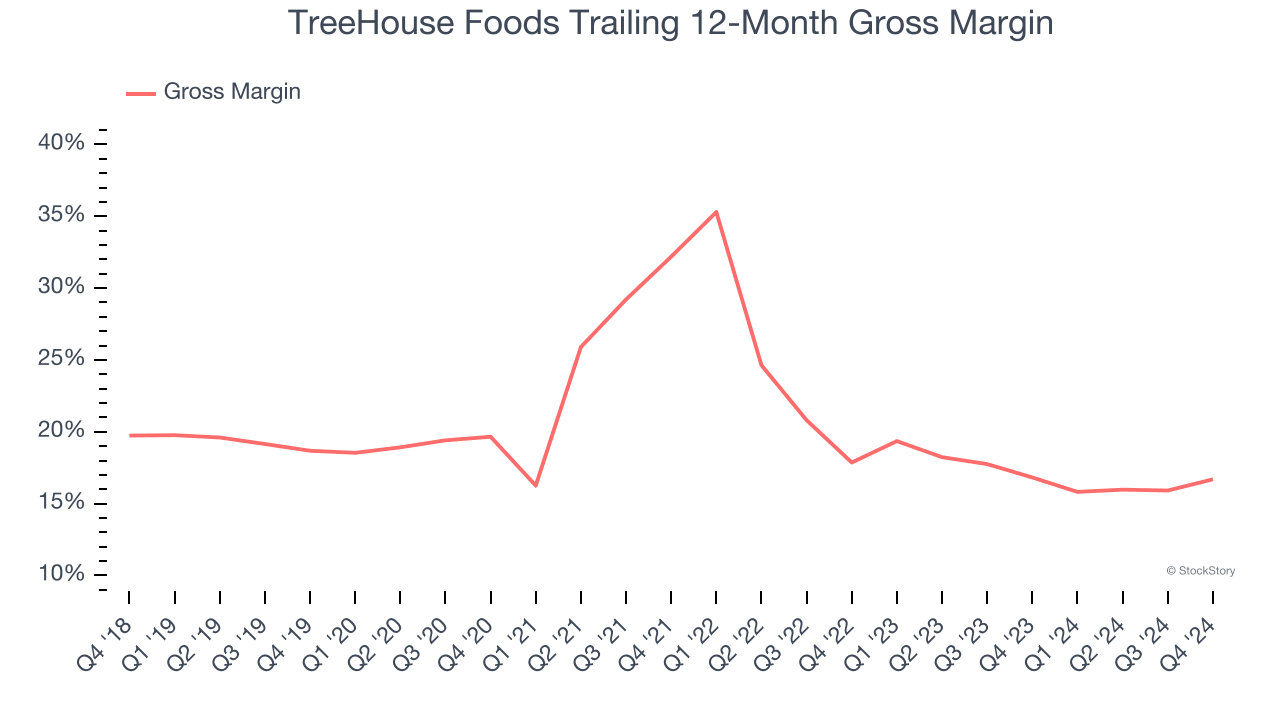

TreeHouse Foods exhibits poor unit economics as a consumer staple company, indicating operation within a highly competitive market where it struggles with pricing power due to substitutable products. Over the past two years, the average gross margin was 16.8%. This suggests that TreeHouse Foods incurred significant costs for supplies, paying out $83.24 to vendors for each $100 generated in sales.

3. Past Expansion Plans Have Failed to Impress

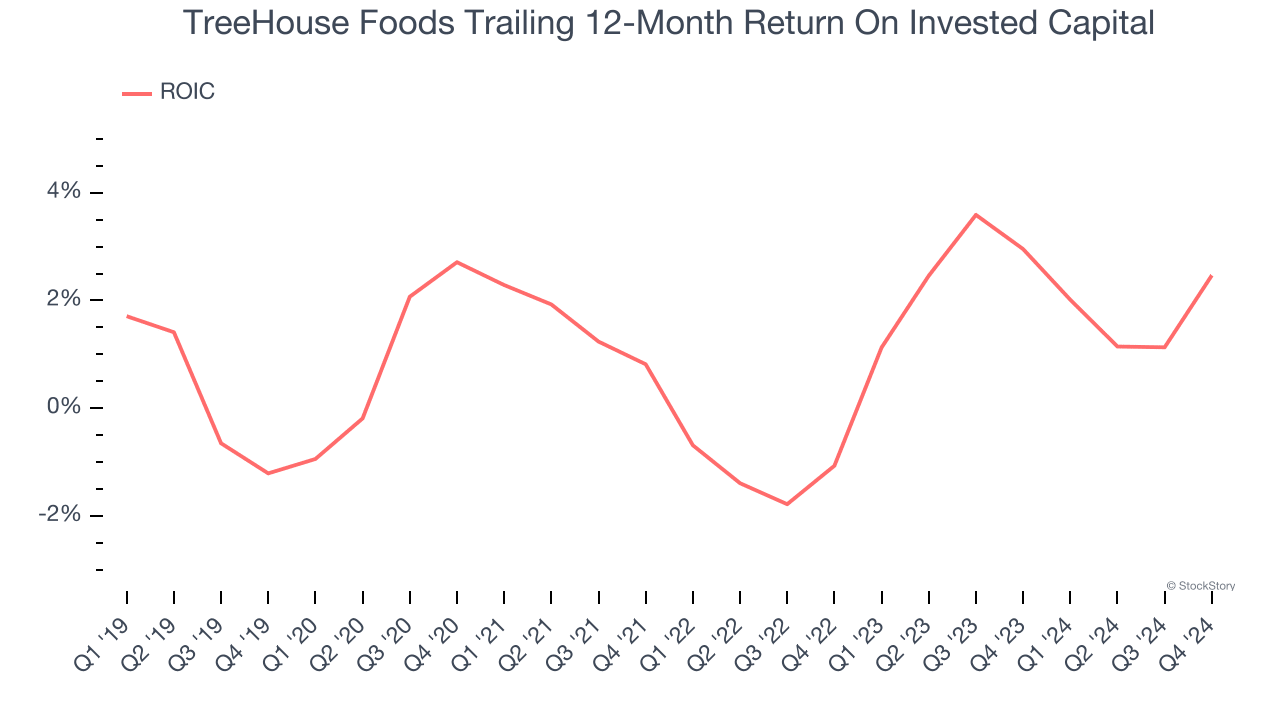

Expanding reveals a company’s prospects over time, yet how efficient was that expansion in terms of capital usage? This efficiency can be gauged through the company’s Return on Invested Capital (ROIC), which illustrates the operating profitability relative to the funds it has gathered (both debt and equity).

Historically, TreeHouse Foods has performed poorly when it comes to investing in profit-generating expansion projects. Over a span of five years, their average Return on Invested Capital (ROIC) stood at just 1.6%, which is below the usual cost of capital for firms within the consumer staples sector.

Final Judgment

TreeHouse Foods does not meet our quality criteria. After the recent downturn, the stock is trading at a forward Price/Earnings ratio of 9.4 times, equivalent to $22.64 per share. Although this might seem like a bargain, the significant risks remain due to its weak underlying metrics. Currently, there are more promising investment options available. Allow us to direct your attention elsewhere instead. A leading aerospace company that has refined its merger and acquisition strategy. .

Companies We Prefer Over TreeHouse Foods

The triumph of Donald Trump in the 2024 U.S. Presidential Election initially propelled key stock indexes to record peaks; however, these gains have since been erased due to investor uncertainty regarding economic conditions and the possible effects of new tariffs.

Although this creates significant ambiguity surrounding 2025, several businesses are well-positioned for sustained growth irrespective of the political landscape or broader economic conditions, similar to ours. Top 6 Equities to Watch This Week . This is a curated list of our High Quality shares that have delivered a return exceeding the market by 175% in the past five years.

The stocks featured on our roster for 2019 encompassed widely recognized entities like Nvidia (++2,183% from December 2019 through December 2024), along with lesser-known firms such as Sterling Infrastructure (++1,096% over five years). Discover your next major success with StockStory now at no cost. .

0 Response to "3 Pitfalls of THS and the Single Stock to Consider"

Post a Comment